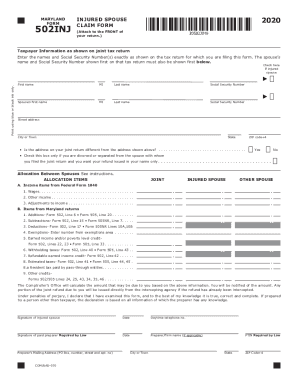

Get Md 502inj 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MD 502INJ online

How to fill out and sign MD 502INJ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Confirming your earnings and filing all the crucial taxation papers, including MD 502INJ, is a US citizen?s exclusive responsibility. US Legal Forms makes your tax management a lot more accessible and efficient. You will find any lawful forms you want and fill out them electronically.

How to prepare MD 502INJ on the internet:

-

Get MD 502INJ in your web browser from your device.

-

Open the fillable PDF file with a click.

-

Start accomplishing the template box by box, using the prompts of the sophisticated PDF editor?s interface.

-

Precisely type textual content and numbers.

-

Tap the Date box to set the actual day automatically or alter it manually.

-

Apply Signature Wizard to design your custom-made e-signature and certify within minutes.

-

Check Internal Revenue Service directions if you still have any queries..

-

Click Done to save the edits..

-

Go on to print the record out, save, or send it via E-mail, SMS, Fax, USPS without quitting your browser.

Store your MD 502INJ securely. You should make sure that all your correct paperwork and data are in are in right place while remembering the deadlines and taxation rules set by the IRS. Help it become simple with US Legal Forms!

How to edit MD 502INJ: customize forms online

Fill out and sign your MD 502INJ quickly and error-free. Find and edit, and sign customizable form templates in a comfort of a single tab.

Your document workflow can be much more efficient if everything you need for modifying and managing the flow is organized in one place. If you are searching for a MD 502INJ form sample, this is a place to get it and fill it out without looking for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Just type the name of the MD 502INJ or any other form and find the right sample. If the sample seems relevant, you can start modifying it right on the spot by clicking Get form. No need to print out or even download it. Hover and click on the interactive fillable fields to place your details and sign the form in a single editor.

Use more modifying instruments to customize your form:

- Check interactive checkboxes in forms by clicking on them. Check other areas of the MD 502INJ form text by using the Cross, Check, and Circle instruments

- If you need to insert more textual content into the document, use the Text tool or add fillable fields with the respective button. You can also specify the content of each fillable field.

- Add pictures to forms with the Image button. Upload pictures from your device or capture them with your computer camera.

- Add custom graphic elements to the document. Use Draw, Line, and Arrow instruments to draw on the document.

- Draw over the text in the document if you want to hide it or stress it. Cover text fragments using theErase and Highlight, or Blackout instrument.

- Add custom elements such as Initials or Date using the respective instruments. They will be generated automatically.

- Save the form on your device or convert its format to the one you want.

When equipped with a smart forms catalog and a powerful document modifying solution, working with documentation is easier. Find the form you need, fill it out immediately, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for modifying forms.

Related links form

You can pay the relevant local income taxes on your Maryland state income tax return. There is no separate tax form for county or city income taxes. ... If your Maryland earnings are subject to income taxes, your employer will withhold that money from your paychecks, at the special nonresident rate of 1.75%.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.