Loading

Get Mi 4892 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 4892 online

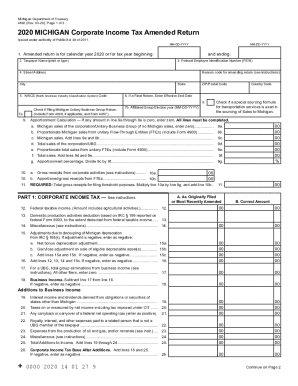

The MI 4892 is the amended Corporate Income Tax return form for taxpayers in Michigan. This guide outlines how to complete the form accurately and efficiently when filing online, ensuring compliance with Michigan tax regulations.

Follow the steps to fill out the MI 4892 effectively.

- Click ‘Get Form’ button to obtain the MI 4892 and open it in your preferred document editor.

- Begin by entering the amended return year, specifying whether it is for calendar year 2020 or another tax year. Fill in the starting and ending dates where applicable.

- Input the taxpayer name clearly in the designated field, using either printed or typed format.

- Provide the Federal Employer Identification Number (FEIN) in the required section.

- Complete the street address, including city, state, and ZIP/Postal code.

- Select a reason code for amending the return by referring to the reason code list in the instructions.

- If applicable, check if you are filing a final return and enter the effective end date.

- Choose to indicate if this is a Michigan Unitary Business Group return, ensuring to include Forms 4896 and 4897 if necessary.

- Fill out the apportionment calculation by entering the relevant sales figures as instructed along with the accompanying calculations to determine the apportionment percentage.

- Complete the sections for gross receipts, federal taxable income, and necessary additions/subtractions as described in the form.

- Proceed with detailing the Corporate Income Tax calculation and provide any necessary deductions or credits.

- Finalize your document by reviewing all entered information for accuracy.

- Once completed, you have options to save any changes, download, print, or share the form based on your preference.

Complete the MI 4892 online today to ensure your amended Corporate Income Tax return is filed accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Before you call, make sure you have all of the information that you need. ... The IRS telephone number is 1-800-829-1040, and they are available from 7 a.m. 7 p.m. Monday thru Friday. ... The first question the automated system will ask you is to choose your language.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.