Loading

Get Mi Dot 4891 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4891 online

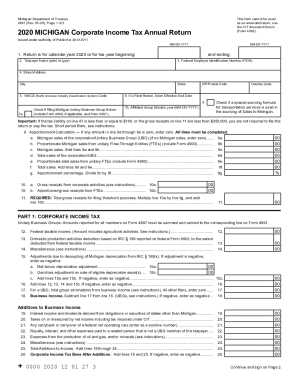

Filing the MI DoT 4891 is an important step in reporting your corporate income tax obligations in Michigan. This guide will walk you through each section of the form, ensuring you have all the necessary information to complete it accurately and efficiently online.

Follow the steps to fill out the MI DoT 4891 online.

- Press the ‘Get Form’ button to access the MI DoT 4891 form and open it in your editor.

- In line 1, enter the tax year or the beginning and ending dates in MM-DD-YYYY format that the return corresponds to.

- For line 2, input the taxpayer name clearly. If applicable, indicate the Designated Member for Unitary Business Groups (UBGs).

- On line 3, provide the Federal Employer Identification Number (FEIN). Make sure to use the same account number consistently across all documents.

- Fill in line 4 with the taxpayer's complete street address, city, state, and ZIP code.

- For line 5, enter the six-digit NAICS code relevant to the business activities. You can refer to the Census Bureau's website for complete codes.

- If the return is final, complete line 6 with the effective end date. If not applicable, leave this blank.

- On line 7, check the box if filing as a UBG and include Form 4897 for each member of the group.

- Move to line 8 and check if any special sourcing formula for transportation services is used, if applicable.

- Proceed to lines 9a through 9g and enter sales data as specified, ensuring all lines are filled accurately.

- Complete lines 10a and 10b with gross receipts and apportioned gross receipts as necessary.

- Continue completing the form as per the instructions provided for each subsequent section and line.

- Once all sections are filled, ensure to check for accuracy, save your changes, and either download, print, or share the form as needed.

Start filling out the MI DoT 4891 online today to meet your corporate tax obligations seamlessly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

About the City Partnership Tax Beginning with the 2016 tax year, all annual returns and payments must be sent to the Michigan Department of Treasury. ... Calendar Filers: Due on the 15th day of the 4th month after the tax year ends.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.