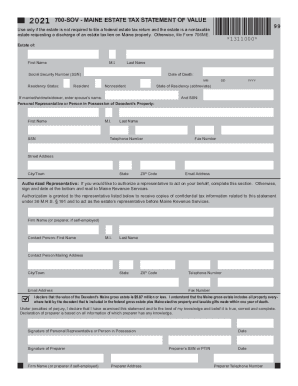

Get Me Mrs 700-sov 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign DECEDENTS online

How to fill out and sign Taxable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Today, most Americans tend to prefer to do their own taxes and, furthermore, to fill out forms in electronic format. The US Legal Forms online service helps make the procedure of preparing the ME MRS 700-SOV simple and handy. Now it will take no more than half an hour, and you can do it from any place.

How you can finish ME MRS 700-SOV quick and easy:

-

View the PDF blank in the editor.

-

Refer to the outlined fillable lines. Here you can insert your information.

-

Click on the variant to choose if you find the checkboxes.

-

Proceed to the Text icon and also other advanced features to manually edit the ME MRS 700-SOV.

-

Confirm every piece of information before you resume signing.

-

Design your custom eSignature by using a key pad, camera, touchpad, computer mouse or cellphone.

-

Certify your PDF form online and indicate the particular date.

-

Click on Done move forward.

-

Save or send out the file to the receiver.

Make sure that you have filled in and delivered the ME MRS 700-SOV correctly in due time. Think about any applicable term. When you give inaccurate info in your fiscal papers, it may result in severe fines and create problems with your annual income tax return. Use only qualified templates with US Legal Forms!

How to edit Worksheet: personalize forms online

Completing papers is easy with smart online tools. Get rid of paperwork with easily downloadable Worksheet templates you can edit online and print.

Preparing documents and paperwork must be more accessible, whether it is a daily element of one’s job or occasional work. When a person must file a Worksheet, studying regulations and instructions on how to complete a form properly and what it should include might take a lot of time and effort. Nevertheless, if you find the proper Worksheet template, completing a document will stop being a struggle with a smart editor at hand.

Discover a broader variety of features you can add to your document flow routine. No need to print, complete, and annotate forms manually. With a smart editing platform, all of the essential document processing features are always at hand. If you want to make your work process with Worksheet forms more efficient, find the template in the catalog, click on it, and see a less complicated method to fill it in.

- If you need to add text in a random part of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you need.

- Use the Highlight tool to stress the key parts of the form. If you need to cover or remove some text parts, utilize the Blackout or Erase tools.

- Customize the form by adding default graphic elements to it. Use the Circle, Check, and Cross tools to add these elements to the forms, if required.

- If you need additional annotations, make use of the Sticky note tool and put as many notes on the forms page as required.

- If the form requires your initials or date, the editor has tools for that too. Reduce the chance of errors using the Initials and Date tools.

- It is also possible to add custom visual elements to the form. Use the Arrow, Line, and Draw tools to customize the document.

The more tools you are familiar with, the better it is to work with Worksheet. Try the solution that offers everything required to find and edit forms in one tab of your browser and forget about manual paperwork.

The U.S. states that collect an inheritance tax as of 2019 are Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.