Loading

Get Fl Rts-6 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL RTS-6 online

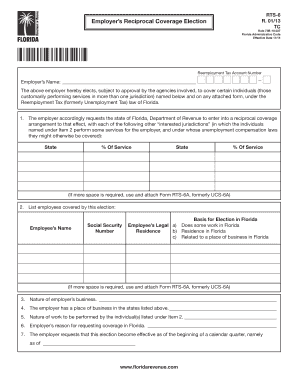

The FL RTS-6 form is crucial for employers in Florida to elect reciprocal coverage under the Reemployment Tax law. This guide offers a step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to complete the FL RTS-6 form online.

- Press the ‘Get Form’ button to access the FL RTS-6 form and open it in the online editor.

- Enter your reemployment tax account number in the designated field, ensuring accuracy as this number is vital for identification.

- Fill in the employer's name. This should be the official name of the business or organization submitting the form.

- In the section that requests a list of interested jurisdictions, indicate the states where employees perform services. For each state, specify the percentage of service provided.

- List the employees covered by this election, including their names and social security numbers, ensuring that all information is current and accurate.

- Indicate the basis for election in Florida by selecting the applicable options related to each employee's work or residence status.

- Describe the nature of your business and include information about your place of business in the states mentioned.

- Provide details regarding the nature of work performed by the listed individuals and state your reasons for requesting coverage in Florida.

- Specify the effective date for the election as it pertains to the beginning of a calendar quarter.

- Review the final instructions regarding notices required for individuals covered by the election and compliance responsibilities.

- After completing the form, save your changes and download or print the completed FL RTS-6 for submission.

- Submit the required signed copies to the Florida Department of Revenue and follow up as necessary.

Complete your FL RTS-6 form online today for streamlined processing and compliance.

Related links form

The SUTA rate is determined by various factors including an employer's tax history and the overall state unemployment rate. New employers typically start at a standard rate, while seasoned employers may see adjustments based on their experience ratings. Keeping track of these rates and ensuring you file your FL RTS-6 on time can prevent unexpected liabilities. Our tools at UsLegalForms can help to clarify your rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.