Loading

Get Fl Rts-6a 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL RTS-6A online

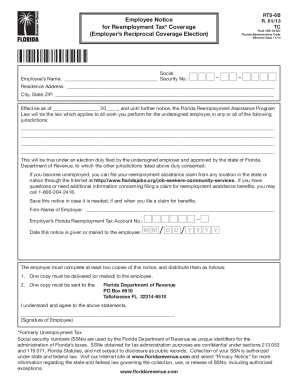

The FL RTS-6A form is an essential document for employers electing reciprocal coverage in Florida. This guide provides clear instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the FL RTS-6A online.

- Press the ‘Get Form’ button to access the FL RTS-6A. This allows you to open the form in your preferred online editor.

- In the first section, list the jurisdictions you are including in Item 1 of the election. For each jurisdiction, specify the state and the percentage of service associated with it.

- Next, provide details for each employee in Item 2 of the election. Include the employee's name and Social Security Number in the designated fields.

- In the section titled 'Basis for Election in Florida,' indicate the reason for the election. Choose from the provided options: does some work in Florida, residence in Florida, or related to a place of business in Florida.

- Complete the firm section by entering the name of the employer responsible for the employees listed.

- After filling in all required information, review the form for accuracy. Once confirmed, you may proceed to save changes, download, print, or share the completed FL RTS-6A.

Complete your forms online today to ensure timely processing!

Related links form

The Florida RT-7 is a report that employers must file if they have employees that are exempt from certain reemployment tax obligations. This includes businesses that do not have enough taxable wages to meet the threshold for filing a standard RT-6. Understanding when to use the RT-7 can help you remain compliant while saving time. Resources like FL RTS-6A can provide clarity on when and how to file this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.