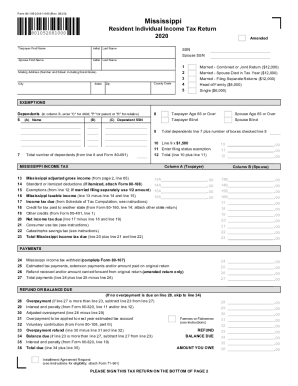

Get Ms Dor 80-105 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MS DoR 80-105 online

How to fill out and sign MS DoR 80-105 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

These days, most Americans prefer to do their own income taxes and, in fact, to fill in forms in electronic format. The US Legal Forms web-based service makes the process of submitting the MS DoR 80-105 simple and convenient. Now it will require a maximum of 30 minutes, and you can accomplish it from any location.

How you can file MS DoR 80-105 quick and easy:

-

Access the PDF template in the editor.

-

See the highlighted fillable lines. This is where to put in your details.

-

Click on the option to select when you see the checkboxes.

-

Go to the Text tool and also other advanced features to manually customize the MS DoR 80-105.

-

Inspect every piece of information before you resume signing.

-

Design your distinctive eSignature using a keyboard, camera, touchpad, mouse or mobile phone.

-

Certify your template electronically and place the date.

-

Click on Done proceed.

-

Download or send out the file to the recipient.

Be sure that you have completed and directed the MS DoR 80-105 correctly in time. Think about any deadline. If you give inaccurate info with your fiscal papers, it may result in serious charges and create problems with your yearly income tax return. Be sure to use only expert templates with US Legal Forms!

How to modify MS DoR 80-105: customize forms online

Check out a single service to handle all your paperwork easily. Find, modify, and complete your MS DoR 80-105 in a single interface with the help of smart instruments.

The times when people needed to print forms or even write them by hand are over. These days, all it takes to get and complete any form, such as MS DoR 80-105, is opening a single browser tab. Here, you can find the MS DoR 80-105 form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the record. Discover instruments that will simplify your paperwork without extra effort.

Click the Get form button to prepare your MS DoR 80-105 paperwork rapidly and start editing it instantly. In the editing mode, you can easily complete the template with your information for submission. Simply click on the field you need to alter and enter the information right away. The editor's interface does not require any specific skills to use it. When finished with the edits, check the information's accuracy once again and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use More instruments to customize your form:

- Use Cross, Check, or Circle instruments to pinpoint the document's data.

- Add textual content or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding instruments.

- Add a date, initials, or even an image to the document if necessary.

- Use the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your file.

Preparing MS DoR 80-105 paperwork will never be complicated again if you know where to look for the suitable template and prepare it easily. Do not hesitate to try it yourself.

Losses and tax deductions While miscellaneous deductions subject to the 2% of adjusted gross income floor are not allowed for 2018 through 2025 under the TCJA, the deduction for gambling losses isn't subject to that floor. So gambling losses are still deductible.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.