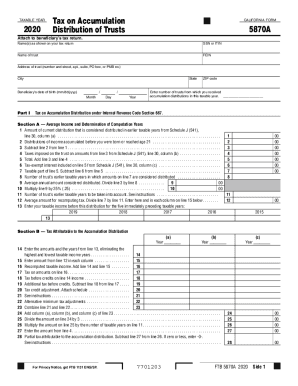

Get Ca Ftb 5870a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign FEIN online

How to fill out and sign Untaxed online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax season started unexpectedly or maybe you just misssed it, it could probably create problems for you. CA FTB 5870A is not the simplest one, but you have no reason for worry in any case.

Utilizing our ultimate on-line software you will understand the best way to complete CA FTB 5870A even in situations of critical time deficit. You only need to follow these simple guidelines:

-

Open the document with our advanced PDF editor.

-

Fill in all the info required in CA FTB 5870A, utilizing fillable fields.

-

Insert images, crosses, check and text boxes, if needed.

-

Repeating information will be added automatically after the first input.

-

In case of misunderstandings, use the Wizard Tool. You will get some tips for much easier finalization.

-

Never forget to add the date of filing.

-

Make your unique signature once and place it in the required fields.

-

Check the information you have included. Correct mistakes if needed.

-

Click on Done to complete modifying and select how you will send it. There is the possibility to use digital fax, USPS or e-mail.

-

Also you can download the document to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

Using our powerful digital solution and its useful instruments, filling in CA FTB 5870A becomes more handy. Don?t wait to try it and spend more time on hobbies and interests instead of preparing files.

How to edit III: customize forms online

Your quickly editable and customizable III template is within reach. Take advantage of our collection with a built-in online editor.

Do you postpone completing III because you simply don't know where to begin and how to proceed? We understand how you feel and have an excellent tool for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-use templates lets you sort through and choose from thousands of fillable forms adapted for a variety of purposes and scenarios. But obtaining the form is just scratching the surface. We offer you all the necessary tools to fill out, sign, and modify the template of your choice without leaving our website.

All you need to do is to open the template in the editor. Check the verbiage of III and verify whether it's what you’re looking for. Start off completing the form by taking advantage of the annotation tools to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and fix the existing text.

- If the template is meant for other people too, you can add fillable fields and share them for other parties to fill out.

- As soon as you’re through completing the template, you can get the document in any available format or select any sharing or delivery options.

Summing up, along with III, you'll get:

- A robust set of editing} and annotation tools.

- A built-in legally-binding eSignature functionality.

- The option to create forms from scratch or based on the pre-uploaded template.

- Compatibility with different platforms and devices for greater convenience.

- Numerous possibilities for safeguarding your files.

- A wide range of delivery options for more frictionless sharing and sending out files.

- Compliance with eSignature frameworks regulating the use of eSignature in online operations.

With our professional tool, your completed forms are always legally binding and totally encrypted. We guarantee to protect your most sensitive info.

Get all it takes to generate a professional-searching III. Make the correct choice and attempt our foundation now!

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.