Loading

Get Ga Dor 600s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR 600S online

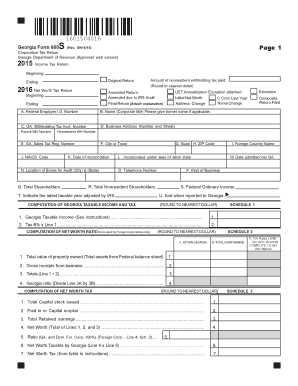

This guide provides a step-by-step approach to completing the Georgia Department of Revenue Form 600S, a vital document for corporation tax returns. Whether you are experienced or new to tax forms, this comprehensive guide will ensure you navigate the process with confidence.

Follow the steps to fill out the GA DoR 600S online:

- Click ‘Get Form’ button to obtain the document and open it for editing.

- Begin by entering the federal employer identification number in field A. This is essential for identification purposes.

- In field B, provide the name of the corporation and include any former names if applicable.

- Enter the Georgia withholding tax account number in field C for proper tax tracking.

- Complete the business address in fields D to F, ensuring it includes street address, city, and zip code.

- Fill in field E with the Georgia sales tax registration number, if applicable.

- Indicate the date of incorporation in field K and the location of books for audit in field N.

- In the computation sections, provide numerical data where indicated, such as total income, Georgia taxable income, and any corresponding calculations as instructed.

- Review all entered data for accuracy and completeness to avoid delays or penalties.

- Finalize your form by saving changes. Options for downloading, printing, or sharing are available for your convenience.

Complete your GA DoR 600S online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To submit your power of attorney to the Georgia Department of Revenue, you typically must complete the appropriate form and send it via fax or mail. Ensuring you use the GA DoR 600S format is critical for compliance and can greatly streamline your submission process. For further clarity, resources like uslegalforms can guide you through the necessary steps to ensure everything is submitted correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.