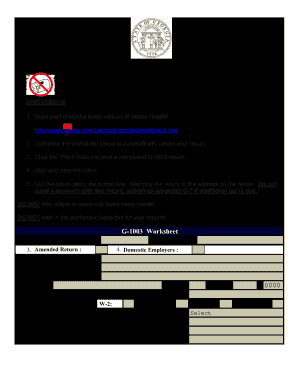

Get Ga Dor G-1003 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR G-1003 online

How to fill out and sign GA DoR G-1003 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your earnings and submitting all the necessary tax filings, including GA DoR G-1003, is an obligation exclusively assigned to US citizens. US Legal Forms facilitates the management of your tax obligations, making them more accessible and precise.

Here’s how to complete GA DoR G-1003 online:

Secure your GA DoR G-1003 carefully. You must ensure all your accurate documentation and information are properly organized while being mindful of the deadlines and tax regulations set by the IRS. Simplify the process with US Legal Forms!

- Access GA DoR G-1003 from your browser on any device.

- Click to open the editable PDF document.

- Start filling out the template systematically, utilizing the prompts from the advanced PDF editor's interface.

- Accurately enter text and numerical data.

- Select the Date field to automatically set the current date or modify it manually.

- Employ the Signature Wizard to create your unique e-signature and validate it in moments.

- Consult the IRS guidelines if you have further inquiries.

- Hit Done to preserve the changes.

- Continue to print the document, download it, or send it via email, text message, fax, or USPS without closing your browser.

How to Modify Get GA DoR G-1003 2012: Personalize Forms Online

Locate the appropriate Get GA DoR G-1003 2012 template and adjust it instantly.

Simplify your documentation with an intelligent document modification solution for online forms.

Your daily process with documents and forms can become more productive when you have everything consolidated in one location. For example, you can locate, acquire, and alter Get GA DoR G-1003 2012 in a single browser window.

If you require a specific Get GA DoR G-1003 2012, it’s easy to track it down using the intelligent search function and access it immediately. There’s no need to download it or search for an external editor to modify it and input your information. All the tools for effective work are included in one comprehensive solution.

After that, you can share or print your document if needed.

- This editing solution allows you to personalize, complete, and sign your Get GA DoR G-1003 2012 form on the spot.

- When you find an appropriate template, simply click on it to enter the editing mode.

- Once the form is opened in the editor, you have all necessary tools readily available.

- It is straightforward to fill in the designated fields and eliminate them if necessary using a simple yet versatile toolbar.

- Execute all modifications instantly and sign the form without leaving the tab by just clicking on the signature area.

Related links form

The G 1003 return is a specific tax form used in Georgia, primarily for reporting payments made to individuals and businesses. It is essential for compliance and accurate records of fiscal activities in the state. If you are obligated to report specific payments, the GA DoR G-1003 will be your go-to return. Solutions such as uslegalforms can help simplify your filing obligations regarding this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.