Loading

Get Ca Cdtfa-230-g-1 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-230-G-1 online

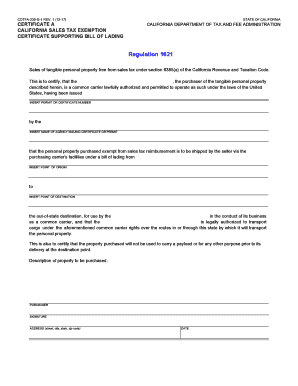

Filling out the CA CDTFA-230-G-1 online can be straightforward if you follow the outlined steps. This guide is designed to assist users in properly completing the form required for California sales tax exemption certification.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the CA CDTFA-230-G-1 and open it for editing.

- In the section labeled 'Purchaser', input the name of the individual or business purchasing the tangible personal property.

- Enter the permit or certificate number issued to the purchaser by the respective authority. This information is required for validation.

- Fill in the name of the agency that issued the certificate or permit in the designated area.

- Specify the point of origin where the personal property will be shipped from.

- Indicate the point of destination, ensuring it reflects the out-of-state location where the property will be delivered.

- Complete the description field with details of the property to be purchased, ensuring accuracy.

- The authorized representative of the purchaser should provide their signature in the specified area.

- Fill in the address of the purchaser, including street, city, state, and zip code.

- Finally, add the date of completion on the form.

- Once all sections are filled out, you can save changes, download, print, or share the completed CA CDTFA-230-G-1 online.

Start filling out your CA CDTFA-230-G-1 online today for a smooth tax exemption process.

Related links form

The CDTFA 230 form is used in California to report specific sales tax information to the CDTFA. This form is critical for ensuring that reported sales align with actual transactions, which protects both taxpayers and the state. Submitting the CDTFA 230 accurately can prevent issues during audits or inspections. Uslegalforms offers a straightforward way to assist you in filling out and understanding this essential document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.