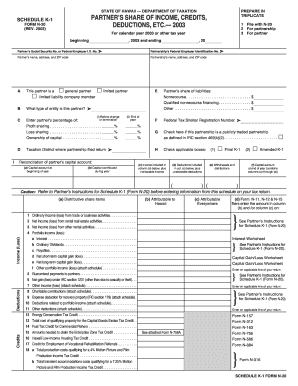

Get Hi Dot N-20 - Schedule K-1 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign N-326 online

How to fill out and sign PREPAREClear online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including HI DoT N-20 - Schedule K-1, is the sole responsibility of a US citizen. US Legal Forms simplifies your tax management, making it more convenient and precise. You can locate any legal forms you need and fill them out electronically.

How to prepare HI DoT N-20 - Schedule K-1 online:

Safeguard your HI DoT N-20 - Schedule K-1. Ensure that all your necessary paperwork and documentation are in order while keeping in mind the deadlines and tax rules established by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access HI DoT N-20 - Schedule K-1 from your web browser on any device.

- Click to open the fillable PDF file.

- Begin completing the online template field by field, adhering to the instructions of the advanced PDF editor's interface.

- Carefully enter text and numbers.

- Click the Date field to automatically set the current date or adjust it manually.

- Use the Signature Wizard to create your personalized e-signature and sign within minutes.

- Consult the IRS guidelines if you have any remaining questions.

- Click on Done to save your modifications.

- Proceed to print the document, save it, or send it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get HI DoT N-20 - Schedule K-1 2003: personalize documents online

Experience a stress-free and paperless method of operating with Get HI DoT N-20 - Schedule K-1 2003. Utilize our dependable online choice and save a significant amount of time.

Creating every document, including Get HI DoT N-20 - Schedule K-1 2003, from ground up demands excessive effort, so having a proven and effective solution of pre-prepared document templates can greatly enhance your productivity.

However, collaborating with them can be challenging, particularly regarding documents in PDF format. Fortunately, our vast collection includes a built-in editor that enables you to swiftly finalize and tailor Get HI DoT N-20 - Schedule K-1 2003 without leaving our site, preventing you from squandering hours altering your documents. Here’s what you can accomplish with your file using our tools:

Whether you need to fill in editable Get HI DoT N-20 - Schedule K-1 2003 or any other document found in our collection, you’re on the right path with our online document editor. It's straightforward and secure, requiring no specialized skills. Our web-based tool is designed to handle practically everything you can think of regarding file editing and completion.

Stop relying on traditional methods of managing your forms. Opt for a more effective solution to assist you in simplifying your tasks and reducing your dependence on paper.

- Step 1: Find the required document on our site.

- Step 2: Click Get Form to access it in the editor.

- Step 3: Utilize our professional editing tools that allow you to insert, delete, annotate, and underline or obscure text.

- Step 4: Create and incorporate a legally-binding signature to your document by using the signing option from the top toolbar.

- Step 5: If the document layout isn't as you desire, use the tools on the right to remove, add extra, and rearrange pages.

- Step 6: Add fillable fields so that others can be invited to complete the document (if applicable).

- Step 7: Distribute or send the document, print it, or select the format in which you would prefer to download the document.

Related links form

To obtain a copy of your Schedule K-1, you should first contact the partnership or S corporation that issued it. They should be able to provide another copy or direct you on how to access it. Additionally, if you are facing difficulties, look into uslegalforms as they offer solutions and templates that can assist you in obtaining necessary documents efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.