Loading

Get Ca Cdtfa-401-ez (formerly Boe-401-ez) 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CA CDTFA-401-EZ (formerly BOE-401-EZ) online

Filling out the CA CDTFA-401-EZ online is a straightforward process designed for ease of use. This guide will walk you through each step necessary to complete the form accurately, ensuring you understand every section and field.

Follow the steps to complete the form with confidence.

- Click ‘Get Form’ button to obtain the CA CDTFA-401-EZ form and access it in the online editor.

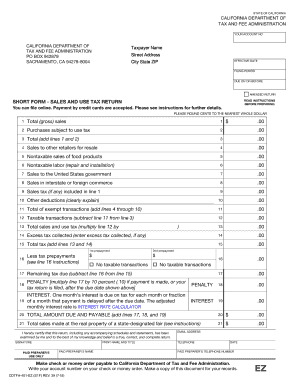

- Begin filling out your taxpayer information, including your account number, name, address, effective date, and filing period. Ensure accuracy, as this data is crucial for correct processing.

- In section 1, report your total (gross) sales. Include all sales related to your California business. Be precise, as this figure sets the foundation for your tax calculations.

- For line 2, enter purchases subject to use tax. This includes items bought without paying California sales tax that are not for resale.

- Calculate the total of lines 1 and 2 and input this amount on line 3.

- For lines 4 to 10, input any sales to other retailers, nontaxable sales of food products, labor charges, sales to the United States government, and any other deductions. Each entry must be explained clearly if it does not fall into standard categories.

- Total the exempt transactions from lines 4-10 and enter the sum on line 11. Then, subtract line 11 from line 3 to determine your taxable transactions on line 12.

- On line 13, multiply the taxable transactions by the applicable tax rate to calculate your total sales and use tax.

- If applicable, report any excess tax collected on line 14 and add this to the total tax calculated on line 13 to determine your total on line 15.

- If required, list any tax prepayments made on line 16 and subtract this from your total tax due on line 15 to find your remaining tax due on line 17.

- If you are filing late, calculate any penalties on line 18 and interest on line 19, and input these amounts.

- Sum lines 17, 18, and 19 to get the total amount due, which you will enter on line 20.

- Finally, if applicable, report any sales made at a state-designated fair on line 21. Review your entries for accuracy and completeness.

- Ensure your signature is present, and follow the instructions for submitting your return, whether online or by mail. You will have the option to save changes, download, print, or share your completed form.

Start completing your CA CDTFA-401-EZ form online today and ensure timely and accurate submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Adjustments on a sales tax return refer to any necessary corrections made to reported sales tax figures. These can include changes due to returned merchandise, credits, or incorrect calculations. Using the CA CDTFA-401-EZ (formerly BOE-401-EZ) allows you to make these adjustments accurately. For more information on handling adjustments, consider consulting resources from US Legal Forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.