Loading

Get Hi Dot N-35 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-35 online

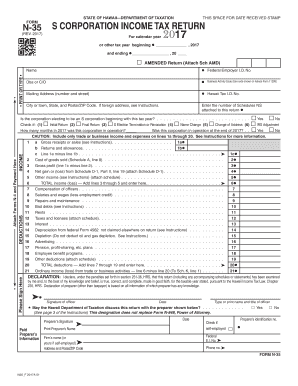

The HI DoT N-35 form is the S Corporation Income Tax Return for the state of Hawaii. This guide provides detailed instructions for completing the form online, ensuring that users can accurately navigate each component of the document.

Follow the steps to successfully complete the HI DoT N-35 form.

- Press the ‘Get Form’ button to access the HI DoT N-35 form and open it in the online editor.

- Start by entering the calendar year for which you are filing the tax return. This information is crucial as it specifies the taxable period for your corporation.

- Fill in the DBA or C/O field with your business name or the name of an individual representing the business. Input your Hawaii Tax I.D. number and Federal Employer I.D. number correctly in the designated fields.

- Complete your mailing address by providing your number and street, along with the city, state, and postal/ZIP code.

- Indicate the number of Schedules NS attached to your return so the authorities can accurately assess your submission.

- In the income section, fill out the gross receipts, returns and allowances, and calculate the net income. Ensure all figures reflect only trade or business income.

- Proceed to the deductions section where you will enter various expenses such as compensation of officers, salaries, rents, and others as outlined in the form.

- Review the amended return checkbox if applicable, and provide information on whether the corporation has been in operation during the specified year.

- Complete the tax and payments section, calculating any taxes due, overpayments, and credits that may apply.

- Finally, ensure to sign the form as required, whether you are the officer or a preparer, and provide the date of signing.

- After filling in all sections, save your changes, and consider downloading, printing, or sharing the final document for your records.

Complete your HI DoT N-35 form online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When opting for direct deposit, Hawaii state tax refunds generally take about one to three weeks after your return has been processed. This method is quicker compared to receiving a paper check. It’s important to ensure that your banking information is accurate upon submission to avoid delays. For faster processing and more effective results, consider the HI DoT N-35 as your guide.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.