Get Hi Dot U-6 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

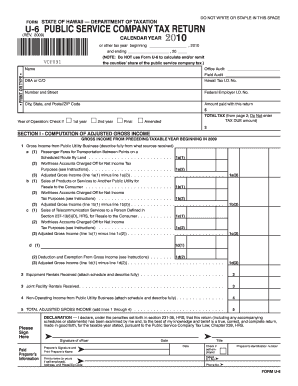

Tips on how to fill out, edit and sign HI DoT U-6 online

How to fill out and sign HI DoT U-6 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

It is solely the responsibility of a US citizen to report their income and provide all essential tax documents, such as the HI DoT U-6. US Legal Forms simplifies and streamlines your tax preparation process.

You can obtain any legal forms you need and complete them digitally.

Store your HI DoT U-6 securely. Ensure that all your correct documents and records are organized while keeping in mind the deadlines and tax regulations established by the IRS. Make it easier with US Legal Forms!

- Access HI DoT U-6 through your web browser on any device.

- Open the fillable PDF file with a single click.

- Begin filling out the online template box by box, following the instructions of the advanced PDF editor's interface.

- Precisely enter the required information and figures.

- Click the Date field to automatically set the current date or modify it manually.

- Utilize the Signature Wizard to create your unique e-signature and sign in moments.

- Refer to the IRS guidelines if you have further questions.

- Press Done to confirm your changes.

- Continue to print the document, save, or send it via Email, SMS, Fax, or USPS without leaving your web browser.

How to modify Get HI DoT U-6 2009: personalize forms online

Select a dependable document editing service you can rely on. Modify, execute, and authorize Get HI DoT U-6 2009 securely online.

Frequently, altering documents, such as Get HI DoT U-6 2009, can be troublesome, particularly if you obtained them online or through email but lack access to specialized tools. Naturally, you may employ some alternatives to address this, but you might end up with a form that does not meet the submission standards. Utilizing a printer and scanner is also not feasible due to the time and resources they require.

We offer a more streamlined and effective method for completing forms. An extensive collection of document templates that are simple to personalize and authorize, making them fillable for certain individuals. Our platform is much more than just a repository of templates. One of the greatest advantages of using our solution is that you can edit Get HI DoT U-6 2009 directly on our site.

As an internet-based solution, it saves you from needing to download any software. Moreover, not all company policies allow you to install it on your work computer. Here’s the simplest way to efficiently and securely execute your forms with our platform.

Disregard paper and other ineffective methods of executing your Get HI DoT U-6 2009 or other documents. Utilize our alternative that consists of one of the most comprehensive libraries of ready-to-customize forms and a robust document editing feature. It's simple and secure, and can save you plenty of time! Don’t just take our word for it, give it a shot yourself!

- Press the Get Form > you’ll be instantly redirected to our editor.

- Once open, you can begin the editing procedure.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Select the date field to insert a specific date into your document.

- Incorporate text boxes, images and notes and more to enhance the content.

- Use the fillable fields feature on the right to introduce fillable {fields.

- Click Sign from the top toolbar to create and affix your legally-binding signature.

- Hit DONE and save, print, and circulate or download the document.

Related links form

The Hawaii employee's withholding allowance and status certificate is an important document that outlines an employee's tax withholding preferences. This document, often related to the HI DoT U-6, helps employers know how much tax to withhold from an employee’s paycheck. It is crucial to fill out this certificate accurately to avoid under- or over-withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.