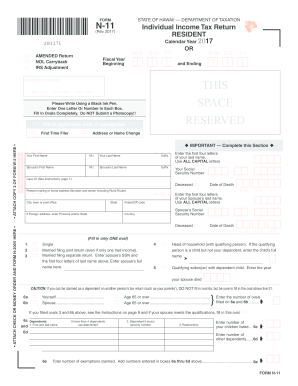

Get Hi N-11 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI N-11 online

How to fill out and sign HI N-11 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and submitting all necessary tax forms, including HI N-11, is the exclusive duty of a US citizen. US Legal Forms makes your tax management simpler and more precise.

You can obtain any legal documents you need and fill them out electronically.

Keep your HI N-11 secured. Ensure that all your accurate documents and information are organized, while being mindful of the deadlines and tax regulations established by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain HI N-11 from your web browser using your device.

- Access the editable PDF file with a click.

- Start completing the online template section by section, following the prompts of the advanced PDF editor's interface.

- Accurately enter text and figures.

- Click the Date box to automatically insert today's date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and sign in moments.

- Review IRS guidelines if you still have any questions.

- Press Done to save your changes.

- Proceed to print the document, save it, or send it via Email, SMS, Fax, or USPS without leaving your browser.

How to Modify Get HI N-11 2017: Personalize Forms Online

Streamline your document preparation process and tailor it to your specifications within moments. Complete and endorse Get HI N-11 2017 using a powerful yet user-friendly online editor.

Document preparation is consistently tedious, especially when it’s something you deal with infrequently. It requires you to meticulously follow all regulations and thoroughly fill out all sections with precise and correct information. However, it often happens that you need to revise the form or add additional sections to complete. If you wish to enhance Get HI N-11 2017 before submitting it, the easiest method is by utilizing our dependable yet straightforward online editing services.

This extensive PDF editing tool allows you to promptly and effortlessly complete legal documents from any internet-enabled device, make straightforward modifications to the form, and add supplementary fillable sections. The service lets you choose a specific field for each data type, such as Name, Signature, Currency, and SSN, among others. You can make these fields mandatory or conditional and designate who is responsible for filling out each field by assigning them to a specific recipient.

Follow the steps below to enhance your Get HI N-11 2017 online:

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and efficiently refining Get HI N-11 2017 along with other templates based on your requirements. Enhance document preparation and submission efficiency, and ensure your forms appear impeccable without any hassle.

- Access the necessary file from the directory.

- Complete the blanks with Text and use Check and Cross tools for the tickboxes.

- Utilize the right panel to adjust the template with new fillable sections.

- Select the fields based on the type of data you wish to gather.

- Set these fields as mandatory, optional, or conditional and arrange their order.

- Assign each field to a specific party using the Add Signer tool.

- Confirm that all essential changes have been made and click Done.

Related links form

When deciding what to put for your withholding allowance on the HI N-11, consider your personal and financial circumstances. You might claim more allowances if you have dependents or significant deductions. However, if you find it challenging to estimate, using a calculator or consulting with a tax professional can provide clarity. Ultimately, setting the right number of allowances ensures you meet your tax obligations without unnecessary withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.