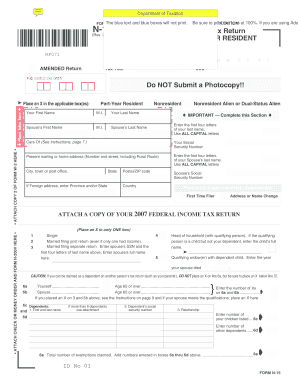

Get Hi N-15 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 59a online

How to fill out and sign 38c online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Registering your earnings and submitting all the essential tax reports, including HI N-15, is a US citizen?s sole responsibility. US Legal Forms helps make your tax managing more accessible and efficient. You will find any juridical samples you want and fill out them digitally.

How to prepare HI N-15 online:

-

Get HI N-15 within your internet browser from your gadget.

-

Access the fillable PDF file with a click.

-

Start completing the web-template field by field, using the prompts of the innovative PDF editor?s user interface.

-

Correctly enter textual material and numbers.

-

Select the Date field to set the actual day automatically or alter it manually.

-

Use Signature Wizard to make your customized e-signature and certify within minutes.

-

Check IRS instructions if you still have inquiries..

-

Click on Done to save the changes..

-

Proceed to print the document out, download, or send it via Email, text messaging, Fax, USPS without exiting your browser.

Keep your HI N-15 securely. You should make sure that all your correct papers and records are in order while remembering the time limits and taxation regulations set up with the IRS. Do it simple with US Legal Forms!

How to edit 38d: customize forms online

Your easily editable and customizable 38d template is within reach. Make the most of our collection with a built-in online editor.

Do you put off completing 38d because you simply don't know where to start and how to proceed? We understand how you feel and have a great solution for you that has nothing nothing to do with overcoming your procrastination!

Our online catalog of ready-to-edit templates lets you search through and choose from thousands of fillable forms tailored for various purposes and scenarios. But obtaining the document is just scratching the surface. We provide you with all the needed tools to fill out, sign, and edit the form of your choosing without leaving our website.

All you need to do is to open the form in the editor. Check the verbiage of 38d and verify whether it's what you’re searching for. Start off completing the form by taking advantage of the annotation tools to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and fix the existing text.

- If the form is intended for other people too, you can add fillable fields and share them for other parties to fill out.

- Once you’re through completing the template, you can get the document in any available format or pick any sharing or delivery options.

Summing up, along with 38d, you'll get:

- A powerful set of editing} and annotation tools.

- A built-in legally-binding eSignature functionality.

- The ability to generate documents from scratch or based on the pre-drafted template.

- Compatibility with different platforms and devices for greater convenience.

- Many possibilities for protecting your documents.

- A wide range of delivery options for more frictionless sharing and sending out documents.

- Compliance with eSignature laws regulating the use of eSignature in online operations.

With our full-featured option, your completed documents are always lawfully binding and completely encrypted. We make sure to guard your most sensitive details.

Get what is needed to make a professional-looking 38d. Make the best choice and try our program now!

Video instructions and help with filling out and completing 42a

Transform an online template into an accurately completed 38f in a matter of minutes. Get rid of tedious work — follow the simple recommendations from the video below.

Related links form

However, you must file a nonresident tax return with Hawaii if you are under 65, and made more than $1,040 of taxable income from Hawaiian sources or if you are above 65 and made more than $2,080 of taxable income in Hawaii. To fill out your nonresident tax return with Hawaii, use Form N-15.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.