Get Hi Uh Wh-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI UH WH-1 online

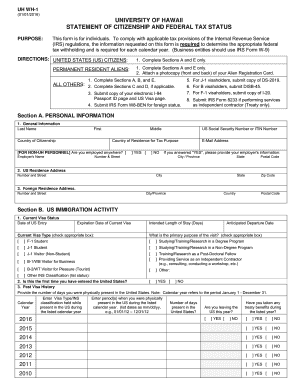

The HI UH WH-1 form is essential for managing your citizenship and federal tax status at the University of Hawaii. This guide provides you with clear, step-by-step instructions to help you fill out the form online effectively.

Follow the steps to complete the HI UH WH-1 form with ease.

- Click the ‘Get Form’ button to access the HI UH WH-1 and open it in your preferred online editor.

- Begin by entering your personal information in Section A. Provide details such as your residence address, ensuring accuracy for both your US and foreign addresses.

- In Section B, specify your current visa status. Indicate whether this is your first time entering the United States and provide your past visa history for the last several years, including 2010 to 2016.

- Section C involves determining your tax status. First, select whether you are a student or non-student. Next, fill in the calendar years and the total number of days you were present in the United States for each year. Calculate the total number of days to count for each year and provide the required ratio.

- Based on your calculations, determine if you are a resident alien or nonresident alien for tax purposes. If you are a resident alien, proceed to Section E. If not, move to Section D.

- In Section D, for nonresident aliens, verify the exemption from withholding. Indicate if you wish to claim a treaty exemption from US federal tax withholding.

- Finally, in Section E, complete the certification of information provided on the form. Ensure all sections are accurately filled out before finalizing your submission.

- Once you have completed the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your HI UH WH-1 form online today to ensure compliance with citizenship and tax requirements.

Get form

Related links form

When filling out the HI UH WH-1 form, you may decide to include an extra amount for withholding to cover any potential tax liability. This amount varies based on your specific financial situation, including anticipated income and expenses. Consulting with a tax professional or using tax planning software can help you determine an appropriate amount for extra withholding. A proactive approach can prevent unexpected tax bills.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.