Loading

Get Ia 1040 Schedule A 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA 1040 Schedule A online

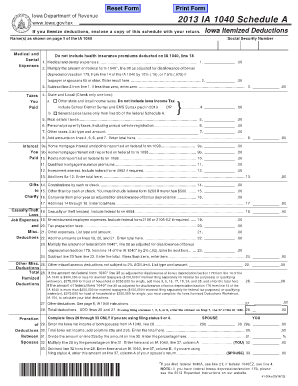

Filling out the IA 1040 Schedule A can help you itemize deductions for your taxes, providing a potentially greater tax benefit. This guide offers clear, step-by-step instructions on how to complete the form online, ensuring you maximize your deductions accurately.

Follow the steps to fill out the IA 1040 Schedule A online effectively

- Click ‘Get Form’ button to access the IA 1040 Schedule A form and open it in the editor.

- Enter your name(s) as shown on the IA 1040 page 1 and your Social Security Number in the designated fields.

- For medical and dental expenses, record the total amount on line 1 and calculate the adjustment on line 2 based on your federal form. Subtract line 2 from line 1 on line 3 – if the result is negative, enter zero.

- In the 'Taxes You Paid' section, indicate whether you paid state and local income taxes or general sales taxes by checking the appropriate box. Report additional taxes, such as real estate taxes and personal property taxes, in their respective lines.

- For 'Interest Paid,' enter amounts from home mortgage interest and qualified mortgage insurance as reported on federal form 1098 in the specified lines. Add these amounts together and enter the total on line 13.

- Document charitable contributions by entering cash or check amounts on line 14 and any other contributions on line 15. Include prior year carryovers on line 16.

- In the 'Job Expenses and Misc. Deductions' section, list unreimbursed employee expenses, tax preparation fees, and any other relevant expenses, calculating totals as instructed.

- Complete the 'Total Deductions' section, ensuring you add and if necessary, refer to the Iowa Itemized Deductions Worksheet for income above specified thresholds.

- For those using certain filing statuses, fill out the proration of deductions between spouses. Ensure you calculate percentages based on net income and report correctly.

- After reviewing all entries for accuracy, save changes, and prepare to download or print the completed IA 1040 Schedule A before submitting it with your return.

Start filling out your IA 1040 Schedule A online today to ensure you capture all eligible deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The taxes deductible on IA 1040 Schedule A include state and local income taxes, real estate taxes, and personal property taxes. Understanding which taxes you can deduct helps in planning your finances effectively. For a more guided experience, consider using platforms like US Legal Forms to organize and file your claims.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.