Loading

Get Ia Dor 35-002 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA DoR 35-002 online

This guide will walk you through the process of completing the IA DoR 35-002 form online. It is designed to help users understand each section and field, ensuring a smooth and accurate submission.

Follow the steps to complete the IA DoR 35-002 form online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

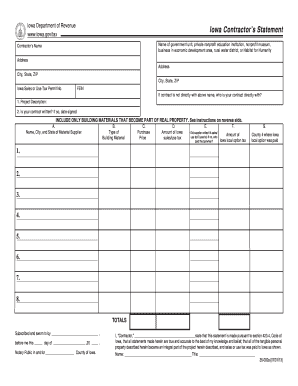

- Fill in the name of the government unit, nonprofit institution, or business in the specified field. Ensure to provide accurate information pertinent to your contract.

- Input the contractor's name and the complete address, including city, state, and ZIP code.

- Enter your Iowa Sales or Use Tax Permit Number and the Federal Employer Identification Number (FEIN).

- Specify the name of the individual or entity with whom the contract is directly held if it differs from the previously entered name.

- In the project description section, provide a concise summary of the project associated with your contract.

- Indicate if the contract is written, and if so, enter the date it was signed.

- List only the building materials that will become part of the real property. Complete columns A through E for each material supplier listed.

- For each material, provide the name, city, and state of the supplier, the type of building material, the purchase price, and the amount of sales/use tax.

- Specify whether the supplier collected Iowa sales/use tax and, if they did not, include details of who paid the tax and when.

- Complete the local option tax details if applicable, including amounts and the county number where the local option was paid.

- Once all sections are filled out, review the information for accuracy.

- Save your changes, and proceed to download, print, or share the completed form as needed.

Start filling out your IA DoR 35-002 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Georgia Form 500EZ. Short Individual Income Tax Return. Georgia Department of Revenue. 201.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.