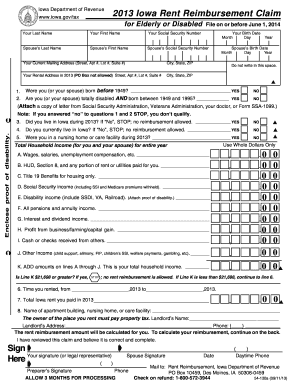

Get Ia Dor 54-130 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IA DoR 54-130 online

How to fill out and sign IA DoR 54-130 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

On behalf of your earnings and providing all necessary tax documents, including IA DoR 54-130, is an obligation of a US citizen. US Legal Forms eases your tax handling significantly and accurately. You can obtain any legal templates you require and complete them digitally.

How you can fill out IA DoR 54-130 online:

Safeguard your IA DoR 54-130 diligently. Ensure that all your essential documents and information are organized while being aware of the deadlines and tax requirements set by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Access IA DoR 54-130 in your web browser from any device.

- Click to open the interactive PDF file.

- Begin completing the web-template box by box, adhering to the instructions of the advanced PDF editor’s interface.

- Enter textual content and figures accurately.

- Choose the Date box to automatically set the current date or manually adjust it.

- Utilize Signature Wizard to create your custom e-signature and sign within moments.

- Consult the Internal Revenue Service guidelines if you have any remaining inquiries.

- Click Done to finalize the modifications.

- Proceed to print the document, download, or send it via Email, text, Fax, or USPS without leaving your browser.

How to alter Get IA DoR 54-130 2013: tailor forms online

Locate the suitable Get IA DoR 54-130 2013 template and modify it immediately. Streamline your documentation process with an intelligent document modification solution for online forms.

Your daily tasks with documents and forms can be more efficient when you have everything you require in one location. For example, you can search for, obtain, and modify Get IA DoR 54-130 2013 within a single browser window. If you need a particular Get IA DoR 54-130 2013, it's easy to locate it with the assistance of the smart search tool and access it instantly. There is no need to download it or seek a third-party editor to amend it and input your details. All the tools for effective work are included in a single consolidated solution.

This modification solution empowers you to customize, complete, and endorse your Get IA DoR 54-130 2013 form right away. As soon as you identify an appropriate template, simply click on it to enter editing mode. When you access the form in the editor, you have all the required tools right at your fingertips. It’s straightforward to fill in the designated fields and delete them if necessary utilizing a simple yet versatile toolbar. Implement all changes instantly and sign the form without leaving the tab by just clicking on the signature area. After that, you can transmit or print your document if needed.

Make additional tailored edits with the available tools.

Explore fresh possibilities in efficient and simple documentation. Locate the Get IA DoR 54-130 2013 you require within minutes and complete it in the same tab. Eliminate the confusion in your paperwork once and for all with the aid of online forms.

- Annotate your document using the Sticky note feature by placing a comment at any point within the document.

- Insert necessary graphical elements, if needed, with the Circle, Check, or Cross tools.

- Adjust or insert text anywhere in the document using Texts and Text box tools. Include content with the Initials or Date feature.

- Modify the template text utilizing the Highlight and Blackout, or Erase tools.

- Insert custom graphical features using the Arrow and Line, or Draw tools.

To fill out your tax withholding form, carefully read through each section to understand what information is required. Make sure to provide accurate details regarding your exemptions, based on the guidance outlined in the IA DoR 54-130. After completing the form, double-check everything to ensure correctness, and submit it to your employer in a timely manner to ensure proper withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.