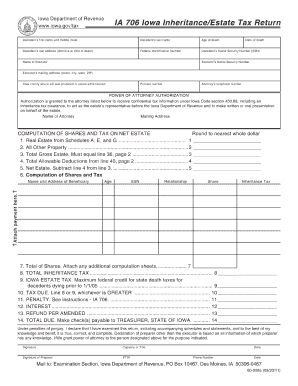

Get Ia Dor 706 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IA DoR 706 online

How to fill out and sign IA DoR 706 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filing your earnings and delivering all the necessary tax documents, including IA DoR 706, is a duty solely for US citizens. US Legal Forms simplifies your tax management, making it more convenient and accurate.

Instructions for completing IA DoR 706 online:

Keep your IA DoR 706 safe. Ensure all your accurate documents and records are organized while keeping the filing deadlines and tax laws set by the IRS in mind. Make it easy with US Legal Forms!

- Obtain IA DoR 706 via your web browser on any device.

- Click to access the fillable PDF form.

- Begin filling out the online template section by section, adhering to the guidance of the advanced PDF editor’s interface.

- Carefully enter text and numerical information.

- Select the Date box to automatically set the current date or adjust it manually.

- Utilize the Signature Wizard to create your personalized e-signature and sign in a matter of seconds.

- Refer to the IRS instructions if you have any lingering questions.

- Click Done to save your changes.

- Continue to print the document, save it, or send it via email, text, fax, or USPS without leaving your web browser.

How to amend Get IA DoR 706 2011: tailor forms on the internet

Place the correct document modification tools at your disposal. Complete Get IA DoR 706 2011 with our reliable software that integrates editing and eSignature capabilities.

If you wish to finalize and validate Get IA DoR 706 2011 online seamlessly, then our web-based solution is the ideal choice. We offer an extensive library of template-based forms ready for you to adapt and complete online. Furthermore, there's no need to print the document or rely on external services to make it fillable. All necessary functionalities will be immediately accessible once you open the document in the editor.

Let’s explore our online editing tools and their primary features. The editor has an intuitive interface, which means you won't need much time to grasp how to use it. We’ll examine three key components that enable you to:

In addition to the functionalities mentioned above, you can secure your document with a password, add a watermark, convert the document into the desired format, and much more.

Our editor simplifies altering and certifying the Get IA DoR 706 2011. It enables you to handle nearly everything related to forms. Moreover, we continually ensure that your document editing experience is secure and adheres to major regulatory standards. All these features make using our tool even more pleasant.

Obtain Get IA DoR 706 2011, make the necessary adjustments and modifications, and download it in your desired file format. Give it a try today!

- Revise and comment on the template

- The upper toolbar features tools that allow you to emphasize and obscure text, without graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Organize your documents

- Utilize the left toolbar to rearrange the document or remove pages.

- Make them distributable

- To create a fillable template for others and share it, you can use the tools on the right to insert various fillable fields, signature and date, text box, etc.

Related links form

To avoid inheritance tax in Iowa, ensure to utilize allowable exemptions and deductions. Be mindful of estate planning strategies such as gifting assets during your lifetime or establishing trusts. While IA DoR 706 outlines various rules, consulting with a tax professional for personalized guidance can also help you minimize tax implications effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.