Get Ia Ia 1041 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

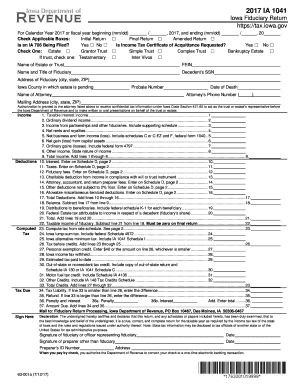

Tips on how to fill out, edit and sign IA IA 1041 online

How to fill out and sign IA IA 1041 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your income and providing all essential tax paperwork, including IA IA 1041, is the exclusive duty of a US citizen. US Legal Forms facilitates your tax organization to be more accessible and precise. You can locate any legal forms you require and complete them online.

How to fill out IA IA 1041 online:

Safeguard your IA IA 1041 properly. Make sure that all your relevant documents and records are organized while keeping in mind the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Access IA IA 1041 through your browser from any device.

- Click to open the fillable PDF document.

- Start entering information in the template field by field, guided by the advanced PDF editor's prompts.

- Carefully input text and numbers.

- Select the Date box to auto-fill the current date or manually adjust it.

- Use the Signature Wizard to create your personalized e-signature and authenticate in moments.

- Consult the Internal Revenue Service guidelines if you have further inquiries.

- Click Done to save the changes.

- Proceed to print the document, download it, or share it via email, SMS, fax, or USPS without leaving your browser.

How to Modify Get IA IA 1041 2017: Personalize Forms Online

Explore a dedicated service to oversee all your documentation effortlessly. Locate, modify, and complete your Get IA IA 1041 2017 within a single dashboard using innovative tools.

The era when individuals needed to print out forms or even complete them by hand is behind us. Nowadays, all it takes to locate and finalize any form, such as Get IA IA 1041 2017, is to open just one browser window. Here, you can access the Get IA IA 1041 2017 form and tailor it in any manner you prefer, from typing directly in the document to sketching it on a digital sticky note and attaching it to the file. Uncover instruments that will enhance your paperwork without added complications.

Simply click the Get form button to prepare your Get IA IA 1041 2017 documents swiftly and begin editing instantly. In the editing mode, you can effortlessly populate the template with your details for submission. Just click on the field you wish to modify and input the information right away. The editor’s interface does not require any particular expertise to operate. Once you’ve finished the modifications, verify the details’ accuracy again and endorse the document. Click on the signature section and follow the guidance to eSign the form in no time.

Employ Additional tools to personalize your form:

Completing Get IA IA 1041 2017 forms will no longer be confusing if you know how to find the right template and process it easily. Do not hesitate to give it a try yourself.

- Utilize Cross, Check, or Circle tools to highlight the document's information.

- Incorporate textual content or fillable text fields with text customization options.

- Remove, Emphasize, or Obscure text sections in the document using respective tools.

- Add a date, initials, or even a graphic to the document if needed.

- Use the Sticky note tool to comment on the form.

- Leverage the Arrow and Line, or Draw tool to insert visual elements into your document.

Related links form

If an estate has no income, generally, you do not need to file form 1041. However, certain conditions, such as the estate's size or specific circumstances regarding beneficiaries, might still require filing for transparency. It is wise to consult the guidelines related to IA IA 1041 or reach out to professionals for clarification to ensure compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.