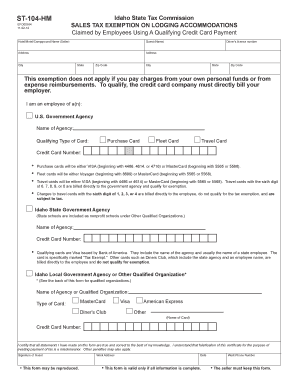

Get Id St-104-hm 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ID ST-104-HM online

How to fill out and sign ID ST-104-HM online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Validating your earnings and submitting all necessary tax documents, including ID ST-104-HM, is a US citizen's exclusive obligation.

US Legal Forms facilitates a more straightforward and precise tax filing process.

Store your ID ST-104-HM safely. Ensure all your accurate documents and information are organized while keeping in mind the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Obtain ID ST-104-HM through your web browser on any device.

- Access the fillable PDF file with a single click.

- Commence filling out the template section by section, following the prompts of the advanced PDF editor's interface.

- Accurately enter text and numbers.

- Select the Date field to automatically set the current date or modify it manually.

- Use the Signature Wizard to create your custom e-signature and validate it in minutes.

- Consult the IRS guidelines if you have any remaining questions.

- Click Done to preserve the changes.

- Proceed to print the document, save it, or send it via email, SMS, fax, or USPS without exiting your browser.

How to modify Get ID ST-104-HM 2012: tailor forms online

Your swiftly adjustable and adaptable Get ID ST-104-HM 2012 template is readily available. Utilize our collection featuring a built-in online editor.

Do you delay finalizing Get ID ST-104-HM 2012 because you merely don't know where to start and how to proceed? We sympathize with your situation and have an outstanding tool for you that has nothing to do with battling your procrastination!

Our online repository of ready-to-use templates allows you to browse and select from countless fillable forms modified for a diverse range of usage scenarios. However, acquiring the document is just the beginning. We provide you with all the essential features to fill out, certify, and modify the document of your preference without exiting our website.

All you need to do is to access the document in the editor. Review the wording of Get ID ST-104-HM 2012 and confirm if it meets your needs. Begin altering the form by employing annotation features to give your form a more structured and polished appearance.

In conclusion, with Get ID ST-104-HM 2012, you'll receive:

With our professional tool, your finalized documents are consistently legally binding and completely encrypted. We ensure to protect your most sensitive information.

Obtain everything required to create a polished Get ID ST-104-HM 2012. Make a wise decision and explore our program now!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, black out, and amend the existing text.

- If the document is intended for other users as well, you can incorporate fillable fields and share them for others to complete.

- Once you're finished refining the template, you can download the file in any available format or select any sharing or delivery methods.

- A robust set of editing and annotating capabilities.

- A built-in legally-binding eSignature option.

- The capability to generate documents from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for securing your files.

- A variety of delivery choices for smoother sharing and sending out documents.

- Adherence to eSignature standards regulating the use of eSignature in electronic transactions.

Related links form

Form 910 in Idaho is associated with sales tax exemptions, similar to the ID ST-104-HM for vehicle purchases. This form covers exemptions for specific goods and services. Implementing the correct forms helps facilitate tax exemption claims, enhancing your overall purchasing experience in Idaho.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.