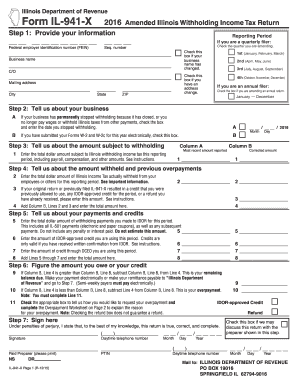

Get Il Dor Il-941-x 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IL DoR IL-941-X online

How to fill out and sign IL DoR IL-941-X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

It is the sole duty of a US citizen to report their income and submit all necessary tax documents, including IL DoR IL-941-X. US Legal Forms facilitates a clearer and more accurate management of your taxes.

Here is how to complete IL DoR IL-941-X online:

Store your IL DoR IL-941-X safely. Ensure all your accurate documents and records are properly organized while keeping the IRS's deadlines and tax regulations in mind. Do it easily with US Legal Forms!

- Obtain IL DoR IL-941-X through your browser on your device.

- Open the fillable PDF form with a single click.

- Start filling out the online template step by step, following the prompts from the sophisticated PDF editor's interface.

- Carefully enter text and numbers.

- Click on the Date field to set the current date automatically or modify it manually.

- Utilize the Signature Wizard to create your personal electronic signature and approve it within a few minutes.

- Consult the Internal Revenue Service guidelines if you have any questions.

- Press Done to save the modifications.

- Continue to print the document, download it, or send it via email, SMS, fax, or USPS without leaving your browser.

How to modify Get IL DoR IL-941-X 2016: personalize forms online

Utilize our sophisticated editor to transform a basic online template into a finished document. Continue reading to discover how to alter Get IL DoR IL-941-X 2016 online effortlessly.

Once you locate an ideal Get IL DoR IL-941-X 2016, all you need to do is modify the template to suit your preferences or legal obligations. Besides completing the fillable form with precise details, you may need to remove certain clauses in the document that don’t pertain to your situation. Conversely, you may wish to incorporate some absent stipulations in the original template. Our advanced document editing tools are the optimal way to modify and adjust the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. You can add and delete text, insert fillable fields, and make additional modifications while preserving the original formatting of the document. Moreover, you can rearrange the layout of the document by altering the page sequence.

There's no need to print the Get IL DoR IL-941-X 2016 to sign it. The editor includes electronic signature capability. Most forms already incorporate signature fields. Therefore, you merely need to affix your signature and request one from the other signing party with a few clicks.

Adhere to this step-by-step guide to prepare your Get IL DoR IL-941-X 2016:

Once all parties finalize the document, you will receive a signed copy that you can download, print, and share with others.

Our services enable you to save a significant amount of time and reduce the possibility of errors in your documents. Enhance your document workflows with effective editing tools and a robust eSignature solution.

- Open the selected template.

- Employ the toolbar to customize the form according to your preferences.

- Complete the form with accurate details.

- Click on the signature field and input your electronic signature.

- Send the document for signature to other signers if required.

Related links form

Verifying your identity on MyTax Illinois involves answering security questions and providing specific personal details. This ensures your account remains secure and that only you can access your tax information. After verification, you can manage all aspects of your tax filings, including the IL DoR IL-941-X form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.