Loading

Get Il Dor Itr-1 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR ITR-1 online

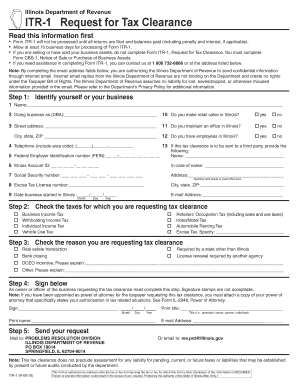

Filling out the IL DoR ITR-1 form online is a straightforward process that requires attention to detail. This guide will provide step-by-step instructions to assist users in completing the Request for Tax Clearance form efficiently and accurately.

Follow the steps to complete the IL DoR ITR-1 form online.

- Begin by clicking the ‘Get Form’ button to access the IL DoR ITR-1 form and open it in the editor.

- Identify yourself or your business by entering your full name, doing business as name (if applicable), street address, city, state, ZIP code, telephone number, Federal Employer Identification Number (FEIN), Illinois Account ID, Social Security number, and Excise Tax License number. Ensure these details are accurate and complete.

- Check all applicable taxes for which you are requesting tax clearance. These include Business Income Tax, Withholding Income Tax, Individual Income Tax, Vehicle Use Tax, Retailers’ Occupation Tax (including sales and use taxes), Hotel/Motel Tax, Automobile Renting Tax, and any relevant Excise Taxes.

- Indicate the reason for requesting tax clearance. Options include real estate transactions, required by a state agency other than Illinois, bank closing, license renewals, DCEO incentives, or any other reason that may require you to explain in detail.

- An owner or officer of the business must complete the signature section. The signature cannot be a stamp, and if you are acting as power of attorney, a copy of your authorization must be attached.

- Finally, send your completed request either by mail or email to the provided addresses. Ensure to keep records of your submission to track the request if needed.

Complete your documents online today to ensure a smooth filing process.

Related links form

To obtain your Illinois state tax return, you can access your information through the MyTax IL portal. After logging in, you can view your return status and download copies if needed. If you have questions about your tax return or need clarification, uslegalforms can provide guidance on how to navigate your state tax information effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.