Get Il Dor P 401 1999-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IL DoR P 401 online

How to fill out and sign IL DoR P 401 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

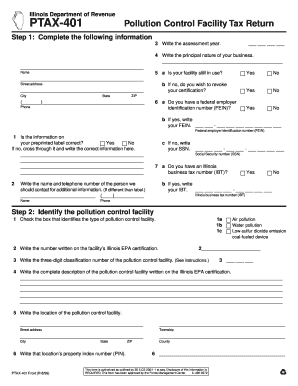

Verifying your earnings and submitting all the essential tax paperwork, including IL DoR P 401, is solely the obligation of a US citizen.

US Legal Forms simplifies your tax administration and enhances its efficiency.

Keep your IL DoR P 401 secure. Ensure that all your accurate documents and information are in the correct location while being mindful of the deadlines and tax laws established by the Internal Revenue Service. Make it simple with US Legal Forms!

- Obtain IL DoR P 401 in your web browser from any device.

- Access the fillable PDF file with a single click.

- Start filling out the online template step by step, following the guidelines of the advanced PDF editing tool's interface.

- Accurately input text and numerical data.

- Click the Date box to automatically set the current date or adjust it manually.

- Utilize Signature Wizard to create your personalized e-signature and sign in a matter of minutes.

- Refer to IRS guidelines if you have any remaining questions.

- Select Done to save your modifications.

- Continue to print the document, download it, or share it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get IL DoR P 401 1999: personalize forms online

Place the appropriate document editing instruments at your disposal. Finish Get IL DoR P 401 1999 with our trustworthy tool that includes editing and eSignature features.

If you desire to complete and validate Get IL DoR P 401 1999 online without any hassle, then our cloud-based online solution is the perfect choice. We offer a comprehensive template-based library of ready-to-use documents that you can alter and complete online. Additionally, you won't have to print the document or employ third-party tools to make it fillable. All the essential instruments will be conveniently available for your use as soon as you access the document in the editor.

Let’s explore our online editing tools and their primary functionalities. The editor presents a user-friendly interface, so it won’t take much time to learn how to utilize it. We’ll examine three main components that allow you to:

In addition to the features outlined above, you can secure your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies completing and certifying the Get IL DoR P 401 1999. It empowers you to perform nearly everything related to handling forms. Furthermore, we always ensure that your experience in modifying files is secure and adheres to the major regulatory standards. All these factors enhance the enjoyment of using our solution.

Obtain Get IL DoR P 401 1999, make the required edits and modifications, and download it in your preferred file format. Give it a try today!

- Alter and comment on the template

- The upper toolbar is equipped with tools that permit you to emphasize and obscure text, without images and graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Employ the left toolbar if you wish to reorganize the document or remove pages.

- Make them shareable

- If you aim to make the document fillable for others and distribute it, you can utilize the tools on the right and add various fillable fields, signature space, date, text box, etc.

Related links form

You should send Illinois tax forms to the addresses specified in the instructions for each form. If you're unsure, the Illinois Department of Revenue’s website provides comprehensive mailing information. Always ensure you use the correct address to avoid processing delays. The IL DoR P 401 includes guidance that can assist you in sending your forms correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.