Loading

Get Il Dor Rmft-5 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR RMFT-5 online

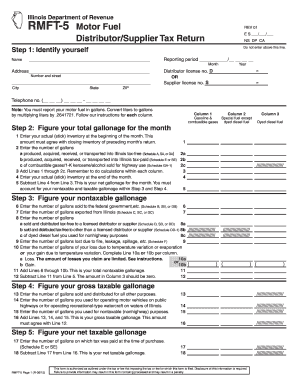

The Illinois Department of Revenue RMFT-5 form is essential for reporting motor fuel tax returns. This guide provides detailed, step-by-step instructions to help users complete the RMFT-5 form online efficiently and accurately.

Follow the steps to complete the RMFT-5 form online.

- Press the ‘Get Form’ button to access the RMFT-5 form and open it in your digital document editor.

- Identify yourself by entering your full name, address, reporting period, distributor license number, supplier license number, and telephone number in the designated fields.

- In Step 2, calculate your total gallonage for the month by entering details in columns for gasoline and special fuel. Follow the prompts to fill in inventory amounts, acquired gallons, and ensure to sum them correctly.

- Proceed to Step 3, where you will determine your nontaxable gallonage. Enter applicable gallons for sales to government entities, exports, tax-free distributions, losses, and evaporation or temperature variations. Calculate the total nontaxable gallonage.

- Continue with Step 4 to figure your gross taxable gallonage by entering the gallons sold and distributed for other purposes, operational use, and nontaxable purposes, ensuring all totals align.

- In Step 5, calculate your net taxable gallonage by entering the gallons on which tax was paid and performing necessary subtraction to derive the correct amount.

- In Step 6, calculate the amount owed by determining your gross tax due based on the net taxable gallonage. Include any deductions for timely payments if applicable, and sum the taxes due.

- Complete Step 7 by entering any credit you wish to apply and subtracting it from your total tax due. This gives the final amount you owe.

- Finally, in Step 8, sign and date your return. Ensure a proper signature from the preparer, and provide contact information. Prepare your payment appropriately.

- After completing all fields, save changes, and either download, print, or share the completed RMFT-5 form as needed.

Complete your IL DoR RMFT-5 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The credit for federal tax on fuel is generally claimed on your federal income tax return. This credit can decrease your overall tax liability. If you are claiming refunds on state taxes, including through the IL DoR RMFT-5, be sure to keep accurate records of these federal credits for your tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.