Get Il Il-1040 Schedule Icr 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

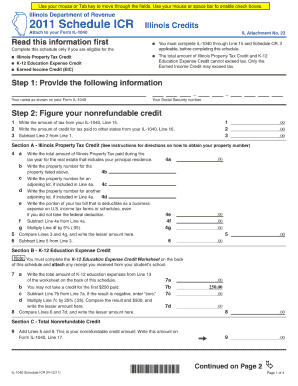

Tips on how to fill out, edit and sign IL IL-1040 Schedule ICR online

How to fill out and sign IL IL-1040 Schedule ICR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

It is the sole duty of a US citizen to report their income and submit all essential tax forms, such as IL IL-1040 Schedule ICR. US Legal Forms simplifies the process of tax preparation, making it more accessible and accurate.

Instructions for completing IL IL-1040 Schedule ICR online:

Store your IL IL-1040 Schedule ICR securely. Ensure that all your relevant documents and information are organized while keeping track of the deadlines and tax regulations set by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access IL IL-1040 Schedule ICR through your internet browser on any device.

- Open the fillable PDF file with a click.

- Begin completing the template step by step, following the instructions of the advanced PDF editor's interface.

- Carefully input text and figures.

- Click on the Date field to automatically insert the current date or edit it manually.

- Use Signature Wizard to create your personalized e-signature and authenticate it in moments.

- Refer to IRS guidelines if you still have any uncertainties.

- Select Done to save the changes.

- Continue to print the document, download it, or share it via Email, SMS, Fax, USPS without leaving your internet browser.

How to amend Get IL IL-1040 Schedule ICR 2011: personalize forms online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Continue reading to discover how to alter Get IL IL-1040 Schedule ICR 2011 online effortlessly.

Once you locate a suitable Get IL IL-1040 Schedule ICR 2011, all you need to do is modify the template to fit your preferences or legal stipulations. Besides filling out the form with precise information, you may wish to eliminate some clauses in the document that are not applicable to your situation. Alternatively, you might want to incorporate any missing elements in the original template. Our advanced document editing tools are the optimal method to correct and modify the form.

The editor enables you to adjust the content of any form, regardless of whether the file is in PDF format. You can add and delete text, insert fillable fields, and implement further changes while retaining the original formatting of the document. Furthermore, you can reorganize the layout of the document by altering the page sequence.

You do not need to print the Get IL IL-1040 Schedule ICR 2011 to endorse it. The editor includes electronic signature capabilities. Most forms already contain signature fields. Thus, all you need to do is affix your signature and request one from the other signing party via email.

Once all parties have signed the document, you will receive a signed copy which you can download, print, and share with others.

Our services enable you to save a significant amount of time and minimize the chances of errors in your documents. Enhance your document workflows with effective editing features and a robust eSignature solution.

- Access the chosen template.

- Utilize the toolbar to customize the form according to your preferences.

- Fill out the form with accurate information.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to other signatories if required.

Related links form

Not everyone in Illinois automatically receives a property tax rebate; eligibility is based on specific criteria such as home ownership and residency status. You need to file the appropriate forms, like Schedule ICR, to claim your rebate. Be aware that various programs and credits may exist, but careful attention to eligibility rules is essential. Always check the Illinois Department of Revenue’s website for up-to-date information.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.