Get Il Ptax-227 1998-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

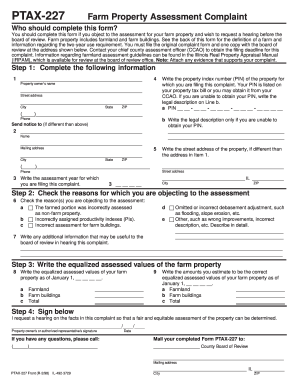

Tips on how to fill out, edit and sign IL PTAX-227 online

How to fill out and sign IL PTAX-227 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Recording your income and reporting all significant tax documents, including IL PTAX-227, is a responsibility of a U.S. citizen.

U.S. Legal Forms simplifies the management of your taxes, making it more straightforward and precise.

Keep your IL PTAX-227 secure. Ensure that all your accurate documents and records are in the proper location while considering the deadlines and tax regulations set by the IRS. Simplify the process with U.S. Legal Forms!

- Access IL PTAX-227 from any device through your browser.

- Click to open the fillable PDF file.

- Start filling out the web template field by field, using the prompts from the advanced PDF editor’s interface.

- Enter text and numbers accurately.

- Click on the Date field to automatically insert the current date or adjust it manually.

- Utilize the Signature Wizard to create your unique e-signature and authorize in minutes.

- Refer to the Internal Revenue Service guidelines if you have any remaining questions.

- Press Done to save the modifications.

- Continue to print the document, download it, or share it via email, text, fax, or USPS without leaving your browser.

How to adjust Get IL PTAX-227 1998: tailor forms digitally

Select the appropriate Get IL PTAX-227 1998 template and alter it immediately.

Enhance your documentation with an intelligent form editing solution for digital forms.

Your everyday tasks involving documentation and forms can be more efficient when you have everything you need consolidated in one location. For instance, you can locate, obtain, and alter Get IL PTAX-227 1998 in a single browser tab.

If you require a specific Get IL PTAX-227 1998, you can effortlessly locate it with the assistance of the intelligent search feature and access it instantly. You are not required to download it or hunt for an external editor to change it and enter your information. All the tools for productive work are included in one comprehensive solution.

Subsequently, you can send or print your document if needed.

- This editing solution enables you to customize, complete, and sign your Get IL PTAX-227 1998 form instantly.

- As soon as you find a suitable template, click on it to enter the editing mode.

- After opening the form in the editor, you have all the necessary tools at your disposal.

- It is simple to fill out the designated fields and eliminate them if needed using a straightforward yet versatile toolbar.

- Make all the changes immediately, and sign the form without exiting the tab by clicking the signature field.

Related links form

A quitclaim deed in Illinois is a legal document that transfers ownership interest in a property from one party to another without any warranties or guarantees. Unlike traditional deeds, a quitclaim deed does not assure the buyer that the title is clear. It is often used among family members or in situations where trust is established. Understanding the implications of using a quitclaim deed can help in preparing any necessary forms, including the IL PTAX-227.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.