Get Il Ptax-329 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

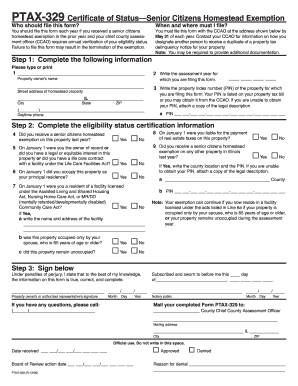

Tips on how to fill out, edit and sign IL PTAX-329 online

How to fill out and sign IL PTAX-329 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your earnings and providing all the necessary tax documents, including IL PTAX-329, is the only responsibility of a US citizen. US Legal Forms simplifies your tax preparation process, making it easier and more efficient. You can acquire any legal templates you need and fill them out electronically.

How to complete IL PTAX-329 online:

Keep your IL PTAX-329 secure. Ensure that all your necessary documents and records are organized while being mindful of the deadlines and tax regulations imposed by the Internal Revenue Service. Make it easy with US Legal Forms!

- Access IL PTAX-329 through your web browser from your device.

- Open the fillable PDF form with a click.

- Begin filling out the online template field by field, following the guidance of the advanced PDF editor's interface.

- Accurately input text and numbers.

- Click on the Date box to automatically insert the current date or manually adjust it.

- Use the Signature Wizard to create your personalized e-signature and sign in mere seconds.

- Consult the Internal Revenue Service guidelines if you have any inquiries.

- Press Done to finalize the modifications.

- Proceed to print the document, download it, or send it via email, SMS, fax, or USPS without leaving your browser.

How to modify Get IL PTAX-329 2009: personalize forms online

Experience a hassle-free and paperless approach to managing Get IL PTAX-329 2009. Utilize our trustworthy online platform and save significant time.

Creating each form, including Get IL PTAX-329 2009, from the ground up demands excessive effort. Therefore, having a reliable platform with pre-uploaded document templates can dramatically enhance your efficiency.

However, utilizing them can be challenging, particularly when dealing with PDF files. Thankfully, our vast collection includes an integrated editor that allows you to conveniently complete and modify Get IL PTAX-329 2009 without leaving our site, preventing any delays in processing your forms. Here’s what you can accomplish with your document using our tool:

Whether you need to process editable Get IL PTAX-329 2009 or any other document in our collection, you’re on the right track with our online document editor. It’s straightforward and secure and doesn’t require specialized skills.

Our web-based tool is crafted to handle virtually everything you can envision regarding document editing and completion. Move on from the outdated methods of managing your documents. Choose a more effective solution to facilitate your tasks and reduce dependence on paper.

- Step 1. Locate the required document on our platform.

- Step 2. Click Get Form to open it in the editing tool.

- Step 3. Utilize our specialized editing capabilities to insert, delete, annotate, and highlight or obscure text.

- Step 4. Create and attach a legally-binding signature to your document using the sign option from the top menu.

- Step 5. If the document’s layout doesn’t appear as needed, use the features on the right to erase, add, and rearrange pages.

- Step 6. Add fillable fields so others can be invited to complete the document (if necessary).

- Step 7. Distribute or send the form, print it, or select the format in which you wish to receive the document.

Related links form

The senior exemption reduces the overall assessed value of your property to lower your tax bill, while the senior freeze specifically locks in the assessed value to prevent any increase. Both programs aim to assist seniors financially, but they serve different purposes. By filing the IL PTAX-329, you can apply for either or both to maximize your benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.