Loading

Get Ca Ftb 3587 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3587 online

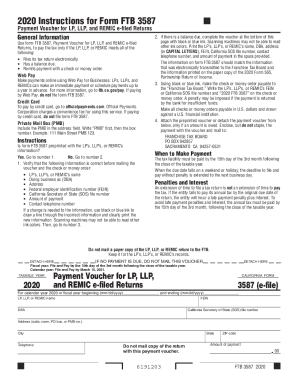

Filling out the CA FTB 3587 form is essential for entities such as limited partnerships (LPs), limited liability partnerships (LLPs), and real estate mortgage investment conduits (REMICs) when paying taxes electronically. This guide provides step-by-step instructions to help you accurately complete the form online.

Follow the steps to complete the CA FTB 3587 form.

- Click ‘Get Form’ button to obtain the CA FTB 3587 form and open it in your preferred digital editor.

- If the form is preprinted with the LP’s, LLP’s, or REMIC’s information, verify that all details are correct before mailing the voucher and payment. These details include the entity's name, doing business as (DBA), address, federal employer identification number (FEIN), California Secretary of State (SOS) file number, payment amount, and contact telephone number. Make corrections by drawing a line through incorrect information and clearly printing the correct information using black or blue ink.

- If no preprinted information is available, you will need to fill out the voucher section at the bottom of the page. Use black or blue ink to print the entity’s name, DBA, address (in capital letters), FEIN, California SOS file number, contact telephone number, and amount of payment.

- Ensure that the information on form FTB 3587 matches what was electronically communicated to the Franchise Tax Board and what is shown on the paper copy of the 2020 Form 565.

- Prepare your payment by making a check or money order payable to the ‘Franchise Tax Board.’ Write the FEIN or California SOS file number and ‘2020 FTB 3587’ on the payment. Be mindful that a penalty may be assessed if your payment is returned due to insufficient funds.

- Attach the completed voucher and include your payment, but do not staple them together. Then, mail them to the following address: FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531.

- Remember that the payment must be made by the 15th day of the third month following the close of the taxable year to avoid late payment penalties and interest.

Complete your CA FTB 3587 form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.