Loading

Get Ct Op-383 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT OP-383 online

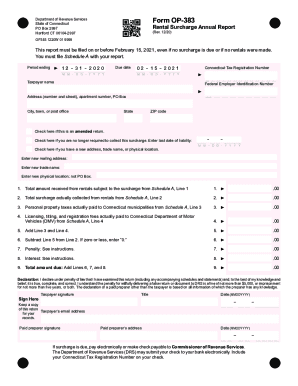

The CT OP-383 form is an essential document for reporting rental surcharges in the state of Connecticut. This guide will provide step-by-step instructions on completing the form online, ensuring that you have all the necessary information for a successful filing.

Follow the steps to complete the CT OP-383 form online.

- Click the ‘Get Form’ button to access the CT OP-383 and open it for editing.

- Fill in the 'Period ending' field with the appropriate date, which is typically December 31 of the reporting year.

- Enter the 'Taxpayer name' in the designated field, followed by the 'Address' including apartment number or PO Box, along with the 'City, town, or post office' and 'ZIP code'.

- Input the 'Connecticut Tax Registration Number' and 'Federal Employer Identification Number' as required.

- Indicate any applicable checkboxes for an amended return, if you are no longer required to collect the surcharge, or if any address or trade name has changed.

- Proceed to report your total amounts in Lines 1 through 9 by accurately transferring figures from Schedule A to the relevant lines on Form OP-383.

- Complete the 'Declaration' section by signing and dating the form. Ensure that all information is truthful and complete.

- After completing all sections, review the form for accuracy and completeness before submission.

- Finally, save your changes, download the completed form, and print it as needed. Ensure that all copies of Schedule A are submitted along with Form OP-383.

Complete your online documents efficiently by filling out the CT OP-383 today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Find this on any previously filed quarterly tax return (Form NYS-45). Call the NY Department of Labor at 888-899-8810.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.