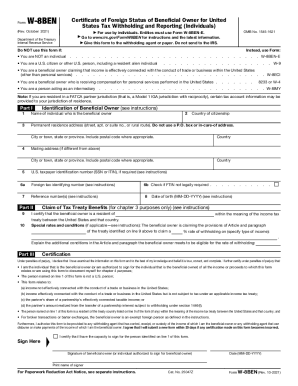

Get Irs W-8ben 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-8BEN online

How to fill out and sign IRS W-8BEN online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your earnings and submitting all the essential taxation reports, including IRS W-8BEN, is a US citizen?s sole obligation. US Legal Forms helps make your tax managing more available and accurate. You can find any lawful blanks you need and fill out them in electronic format.

How to complete IRS W-8BEN online:

-

Get IRS W-8BEN within your internet browser from any gadget.

-

Access the fillable PDF file making a click.

-

Start filling out the template field by field, using the prompts of the advanced PDF editor?s interface.

-

Correctly enter textual information and numbers.

-

Press the Date field to place the actual day automatically or alter it manually.

-

Use Signature Wizard to make your customized e-signature and certify within minutes.

-

Use the IRS directions if you still have questions..

-

Click on Done to confirm the changes..

-

Proceed to print the file out, save, or send it via E-mail, SMS, Fax, USPS without quitting your web browser.

Keep your IRS W-8BEN safely. You should make sure that all your correct paperwork and data are in are in right place while bearing in mind the time limits and tax regulations established with the IRS. Help it become straightforward with US Legal Forms!

How to edit IRS W-8BEN: customize forms online

Your easily editable and customizable IRS W-8BEN template is within reach. Take advantage of our library with a built-in online editor.

Do you postpone completing IRS W-8BEN because you simply don't know where to begin and how to move forward? We understand your feelings and have an excellent tool for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-edit templates enables you to search through and pick from thousands of fillable forms tailored for a variety of purposes and scenarios. But obtaining the document is just scratching the surface. We provide you with all the needed features to fill out, certfy, and change the form of your choice without leaving our website.

All you need to do is to open the form in the editor. Check the verbiage of IRS W-8BEN and verify whether it's what you’re searching for. Start off completing the template by using the annotation features to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and fix the existing text.

- If the form is intended for other people too, you can add fillable fields and share them for others to fill out.

- As soon as you’re through completing the template, you can get the document in any available format or choose any sharing or delivery options.

Summing up, along with IRS W-8BEN, you'll get:

- A powerful set of editing} and annotation features.

- A built-in legally-binding eSignature functionality.

- The option to create forms from scratch or based on the pre-uploaded template.

- Compatibility with different platforms and devices for greater convenience.

- Numerous possibilities for safeguarding your documents.

- An array of delivery options for easier sharing and sending out documents.

- Compliance with eSignature laws regulating the use of eSignature in electronic transactions.

With our professional solution, your completed forms will always be legally binding and fully encoded. We guarantee to guard your most hypersensitive information.

Get what is needed to generate a professional-hunting IRS W-8BEN. Make a good choice and check out our foundation now!

A W-8BEN (Individual) completed without a US taxpayer identification number, is in effect beginning on the date signed until the last day of the third succeeding calendar year, in general three years. If a change in circumstances causes any information on the form to be incorrect, this will render the form invalid.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.