Loading

Get Irs 8840 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8840 online

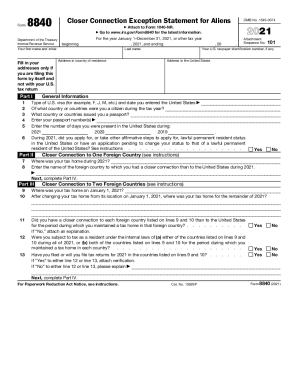

The IRS 8840 form, titled 'Closer Connection Exception Statement for Aliens,' is essential for those seeking to demonstrate a closer connection to a foreign country and establish nonresident status for tax purposes. This guide provides clear, step-by-step instructions on how to accurately complete this form online.

Follow the steps to successfully fill out the IRS 8840

- Press the ‘Get Form’ button to acquire the form and open it for editing.

- Complete Part I by entering your last name, address in your country of residence, and any relevant identification details such as your U.S. taxpayer identification number and visa type.

- Fill in the questions regarding your citizenship, passport issuance, and the number of days present in the United States for the years 2021, 2020, and 2019.

- In Part II, answer if you had a closer connection to one foreign country than to the U.S. during 2021 by providing the name of that country and your tax home location.

- If applicable, complete Part III if you're establishing a closer connection to two foreign countries, detailing both tax home locations and confirming the connections.

- Move on to Part IV to disclose significant contacts with each country, including details such as your permanent home, family, bank, and other personal belongings.

- After meticulously filling out all parts of the form, review your entries for accuracy, then save your changes.

- Download, print, or share the completed form as needed, ensuring it's submitted by the required due date.

Complete your IRS 8840 form online today to ensure proper filing and maintain your nonresident status.

Take note that Form 8840 needs to be filed annually by June 15. The deadline is June 17, 2019, for the 2018 filing, however, as June 15 falls on a Saturday this year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.