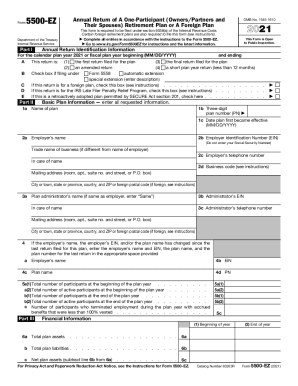

Get Irs 5500-ez 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5500-EZ online

How to fill out and sign IRS 5500-EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren?t associated with document managing and law processes, filling out IRS documents can be extremely tiring. We comprehend the importance of correctly completing documents. Our platform offers the key to make the process of filing IRS docs as elementary as possible. Follow these guidelines to accurately and quickly fill in IRS 5500-EZ.

How to submit the IRS 5500-EZ online:

-

Click on the button Get Form to open it and begin editing.

-

Fill in all required lines in the selected doc utilizing our convenient PDF editor. Switch the Wizard Tool on to complete the procedure even simpler.

-

Check the correctness of filled details.

-

Add the date of submitting IRS 5500-EZ. Make use of the Sign Tool to create an exclusive signature for the record legalization.

-

Complete editing by clicking Done.

-

Send this record straight to the IRS in the most convenient way for you: via e-mail, using digital fax or postal service.

-

You are able to print it on paper when a copy is needed and download or save it to the preferred cloud storage.

Utilizing our platform will make skilled filling IRS 5500-EZ a reality. We will make everything for your comfortable and easy work.

How to edit IRS 5500-EZ: customize forms online

Forget an old-fashioned paper-based way of executing IRS 5500-EZ. Have the form completed and signed in no time with our top-notch online editor.

Are you challenged to revise and fill out IRS 5500-EZ? With a professional editor like ours, you can perform this task in mere minutes without the need to print and scan paperwork back and forth. We offer fully customizable and straightforward form templates that will become a start and help you complete the required form online.

All files, automatically, contain fillable fields you can execute once you open the form. However, if you need to improve the existing content of the form or add a new one, you can select from a number of customization and annotation tools. Highlight, blackout, and comment on the document; add checkmarks, lines, text boxes, images and notes, and comments. Additionally, you can swiftly certify the form with a legally-binding signature. The completed form can be shared with others, stored, imported to external apps, or converted into any popular format.

You’ll never go wrong by choosing our web-based solution to execute IRS 5500-EZ because it's:

- Effortless to set up and utilize, even for users who haven’t completed the paperwork online before.

- Powerful enough to accommodate various editing needs and form types.

- Safe and secure, making your editing experience safeguarded every time.

- Available across different operating systems, making it effortless to complete the form from anyplace.

- Capable of creating forms based on ready-drafted templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT and JPEG etc.

Don't waste time completing your IRS 5500-EZ the old-fashioned way - with pen and paper. Use our feature-rich option instead. It gives you a comprehensive suite of editing tools, built-in eSignature capabilities, and ease of use. The thing that makes it stand out is the team collaboration options - you can collaborate on documents with anyone, create a well-structured document approval flow from A to Z, and a lot more. Try our online tool and get the best bang for your buck!

An employer can apply for an automatic 2 ½ month extension of time to file their Form 5500 by filing a Form 5558 (extending the filing deadline to October 15 for calendar-year plans). The Form 5558 must be filed before the due date of the Form 5500.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.