Loading

Get Ne Dor 1040n 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE DoR 1040N online

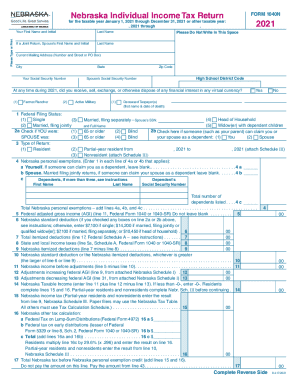

The NE DoR 1040N is the Nebraska Individual Income Tax Return form, essential for reporting state income taxes. This guide provides step-by-step instructions to ensure a smooth online filing process for all users, regardless of their experience level.

Follow the steps to complete your NE DoR 1040N online.

- Press the ‘Get Form’ button to access the NE DoR 1040N and open it in your online editor.

- Begin by providing your last name, followed by your first name and initial. If you are filing a joint return, include your partner’s first name and initial as well.

- Enter your current mailing address, including the street number and name or PO Box, city, and ZIP code.

- Fill in your Social Security number and, if applicable, your spouse’s Social Security number.

- Indicate whether you had any involvement with virtual currency during 2021 by choosing 'Yes' or 'No'.

- Select your federal filing status: options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

- Check the boxes indicating if you or your spouse are 65 or older or blind.

- Determine your type of return: indicate whether you are a resident, partial-year resident, or nonresident.

- Fill out the personal exemptions by entering numbers for yourself, your spouse, and any dependents.

- Provide your federal adjusted gross income as reported on your federal 1040 form.

- Calculate your Nebraska standard deduction based on provided instructions depending on your filing status.

- Complete the lines that pertain to taxable income, deductions, and adjustments as outlined in the form.

- Continue entering your Nebraska income tax, adjustments, credits, and any refunded or due amounts.

- Finalize your return by reviewing all entered information, ensuring accuracy, and saving your changes.

- Once reviewed, you can download, print, or share the form as needed.

Complete your NE DoR 1040N online today for a straightforward tax filing experience.

Employers are required to file Forms W-2 electronically over the Oklahoma Taxpayer Access Point (OKTap) electronic reporting system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.