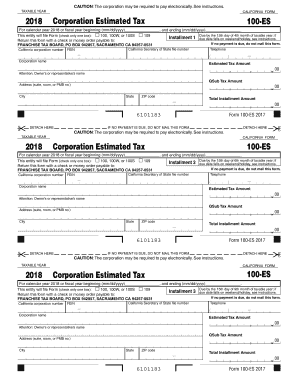

Get Ca Ftb 100-es 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 6th online

How to fill out and sign Gov online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period began unexpectedly or you just misssed it, it would probably cause problems for you. CA FTB 100-ES is not the simplest one, but you do not have reason for panic in any case.

Using our professional service you will see how to fill up CA FTB 100-ES in situations of critical time deficit. The only thing you need is to follow these simple recommendations:

-

Open the file using our professional PDF editor.

-

Fill in the information required in CA FTB 100-ES, making use of fillable fields.

-

Add pictures, crosses, check and text boxes, if you need.

-

Repeating details will be filled automatically after the first input.

-

If you have any misunderstandings, turn on the Wizard Tool. You will see useful tips for simpler finalization.

-

Don?t forget to add the date of filing.

-

Make your unique signature once and place it in all the needed lines.

-

Check the information you have included. Correct mistakes if necessary.

-

Click Done to complete modifying and choose how you will deliver it. You will find the opportunity to use digital fax, USPS or electronic mail.

-

You can even download the file to print it later or upload it to cloud storage.

With this complete digital solution and its beneficial instruments, filling in CA FTB 100-ES becomes more convenient. Do not wait to use it and have more time on hobbies and interests instead of preparing documents.

How to edit Installment: customize forms online

Benefit from the functionality of the multi-featured online editor while completing your Installment. Use the variety of tools to rapidly complete the blanks and provide the requested data in no time.

Preparing paperwork is time-taking and pricey unless you have ready-to-use fillable forms and complete them electronically. The best way to cope with the Installment is to use our professional and multi-functional online editing tools. We provide you with all the important tools for fast document fill-out and allow you to make any adjustments to your templates, adapting them to any requirements. In addition to that, you can make comments on the updates and leave notes for other people involved.

Here’s what you can do with your Installment in our editor:

- Complete the blank fields using Text, Cross, Check, Initials, Date, and Sign options.

- Highlight significant details with a favorite color or underline them.

- Hide sensitive details using the Blackout option or simply remove them.

- Add pictures to visualize your Installment.

- Replace the original text using the one corresponding with your needs.

- Leave comments or sticky notes to communicate with others about the updates.

- Drop extra fillable areas and assign them to particular people.

- Protect the sample with watermarks, place dates, and bates numbers.

- Share the paperwork in various ways and save it on your device or the cloud in different formats after you finish editing.

Working with Installment in our robust online editor is the quickest and most effective way to manage, submit, and share your paperwork the way you need it from anywhere. The tool works from the cloud so that you can access it from any location on any internet-connected device. All templates you create or fill out are securely kept in the cloud, so you can always open them whenever needed and be assured of not losing them. Stop wasting time on manual document completion and eliminate papers; make it all on the web with minimum effort.

Video instructions and help with filling out and completing Qsub

Reduce document preparation complexity by getting the most out of this helpful video guide. Prepare your 12th in a few simple steps. Get accurate templates in the easiest way online.

Related links form

If at least two-thirds of your gross income is from farming or fishing, you can make just one estimated tax payment for the 2019 tax year by January 15, 2020. If you file your 2019 tax return by March 2, 2020, and pay all the tax you owe at that time, you don't need to make any estimated tax payments.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.