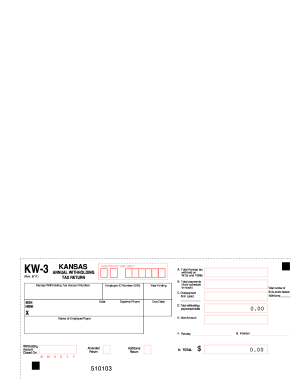

Get Ks Dor Kw-3 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KS DoR KW-3 online

How to fill out and sign KS DoR KW-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your earnings and submitting all the required tax documents, including KS DoR KW-3, is a US citizen's exclusive obligation. US Legal Forms enhances your tax management to be clearer and more accurate. You will discover any legal templates you require and complete them digitally.

How to fill out KS DoR KW-3 online:

Safeguard your KS DoR KW-3. Ensure that all your accurate documents and records are in their appropriate locations while adhering to the deadlines and tax rules established by the IRS. Streamline the process with US Legal Forms!

- Obtain KS DoR KW-3 in your web browser from any device.

- Open the fillable PDF form with a click.

- Begin completing the template section by section, following the guidance of the advanced PDF editor's interface.

- Precisely enter text and figures.

- Click the Date box to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to create your custom e-signature and sign in minutes.

- Refer to the IRS instructions if you have any questions.

- Click Done to save the modifications.

- Proceed to print the document, save it, or share it via Email, text message, Fax, USPS without leaving your web browser.

How to alter Get KS DoR KW-3 2017: personalize forms online

Your swiftly adjustable and modifiable Get KS DoR KW-3 2017 template is at your fingertips. Leverage our collection featuring an integrated online editor.

Do you delay preparing Get KS DoR KW-3 2017 because you just don’t know where to start and how to proceed? We empathize with your sentiments and have a remarkable tool for you that has absolutely nothing to do with overcoming your delays!

Our online inventory of ready-to-use templates allows you to filter through and choose from thousands of fillable forms customized for various applications and scenarios. Yet obtaining the file is merely the beginning. We furnish you with all the requisite tools to finalize, certify, and modify the template of your preference without exiting our platform.

All you require is to launch the template in the editor. Inspect the wording of Get KS DoR KW-3 2017 and confirm whether it’s what you’re looking for. Start filling out the form by utilizing the annotation tools to provide your form a more structured and polished appearance.

In conclusion, in addition to Get KS DoR KW-3 2017, you'll receive:

With our expert solution, your finished documents will nearly always be legally binding and entirely encrypted. We ensure the protection of your most sensitive information.

Obtain what is necessary to create a professional-looking Get KS DoR KW-3 2017. Make the correct decision and try our software now!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, obscure, and amend the current text.

- If the template is meant for additional users as well, you can include fillable fields and distribute them for others to fill out.

- Once you’re done filling the template, you can download the file in any available format or select from various sharing or delivery options.

- A robust set of editing and annotation instruments.

- An integrated legally-binding eSignature ability.

- The capability to generate documents from scratch or based on the pre-prepared template.

- Compatibility with multiple platforms and devices for enhanced convenience.

- Numerous options for safeguarding your files.

- A broad array of delivery methods for smoother sharing and dispatching of files.

- Adherence to eSignature standards governing the application of eSignature in electronic transactions.

Related links form

In Kansas, you must file a tax return if your gross income meets specific thresholds based on your filing status and age. Generally, individuals must file if their income exceeds $5,000 or if they owe taxes. Knowing the minimum income requirements can prevent unnecessary penalties, and resources like the KS DoR KW-3 can assist in determining your filing obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.