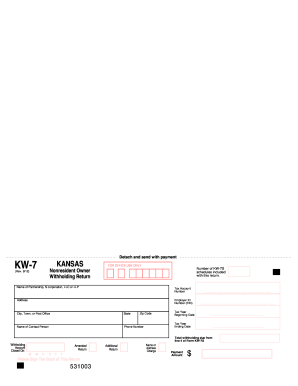

Get Ks Dor Kw-7 & Kw-7s 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KS DoR KW-7 & KW-7S online

How to fill out and sign KS DoR KW-7 & KW-7S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Validating your income and reporting all essential tax documents, including KS DoR KW-7 & KW-7S, is a duty exclusive to US citizens. US Legal Forms simplifies your tax management, making it more straightforward and precise. You can find all the necessary legal forms and complete them electronically.

How to fill out KS DoR KW-7 & KW-7S online:

Keep your KS DoR KW-7 & KW-7S safe. Ensure all your accurate documents and records are organized while being attentive to the deadlines and tax regulations established by the IRS. Make it easy with US Legal Forms!

- Obtain KS DoR KW-7 & KW-7S on your web browser from any device.

- Access the fillable PDF file with a single click.

- Begin entering information in the template field by field, following the prompts of the advanced PDF editor's interface.

- Accurately input text and figures.

- Click the Date field to automatically set the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and validate in seconds.

- Refer to IRS guidelines if you have any remaining queries.

- Select Done to store the modifications.

- Go ahead to print the document, save, or share it via Email, text, Fax, or USPS without leaving your web browser.

How to modify Get KS DoR KW-7 & KW-7S 2012: tailor forms online

Streamline your document crafting process and adapt it to your needs in just a few clicks. Complete and endorse Get KS DoR KW-7 & KW-7S 2012 using a powerful yet user-friendly online editor.

Handling documents is often tedious, especially when you handle it infrequently. It requires you to meticulously adhere to all the protocols and accurately fill in all fields with complete and precise information. Nevertheless, it frequently occurs that you need to modify the form or add additional fields to complete. If you wish to refine Get KS DoR KW-7 & KW-7S 2012 prior to its submission, the easiest method is to utilize our strong yet simple online editing tools.

This all-inclusive PDF editing instrument enables you to effortlessly and swiftly accomplish legal documentation from any device with internet access, make fundamental alterations to the form, and insert more fillable segments. The service permits you to select a specific area for each type of information, such as Name, Signature, Currency, and SSN, etc. You can designate them as compulsory or conditional and decide who is responsible for completing each field by assigning them to a designated recipient.

Follow the steps below to alter your Get KS DoR KW-7 & KW-7S 2012 online:

Our editor is a flexible multi-functional online solution that can assist you in rapidly and effortlessly enhancing Get KS DoR KW-7 & KW-7S 2012 along with other forms according to your specifications. Streamline document preparation and submission times while making your paperwork flawless without difficulty.

- Access the required file from the directory.

- Fill in the gaps with Text and position Check and Cross symbols in the checkboxes.

- Utilize the right-side toolbar to modify the template with new fillable sections.

- Select the fields based on the type of data you wish to collect.

- Designate these fields as mandatory, optional, or conditional and customize their sequence.

- Assign each section to a particular party using the Add Signer feature.

- Verify that you have made all necessary modifications and click Done.

Related links form

Yes, Kansas does maintain a state withholding tax system that requires employers to withhold a portion of employees' wages for state income tax. This withholding is an essential aspect of compliance with Kansas tax laws. Understanding how state withholding works can help you better manage your financial responsibilities. The KS DoR KW-7 & KW-7S forms are key resources in navigating these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.