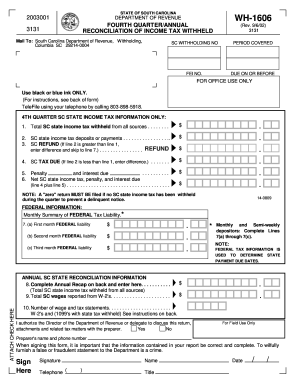

Get Sc Dor Wh-1606 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR WH-1606 online

How to fill out and sign SC DoR WH-1606 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax blank completion can turn into a significant problem and severe headache if no proper guidance supplied. US Legal Forms has been produced as an on-line resolution for SC DoR WH-1606 e-filing and provides numerous benefits for the taxpayers.

Use the tips on how to fill in the SC DoR WH-1606:

-

Get the template online inside the respective section or via the Search engine.

-

Select the orange button to open it and wait until it?s done.

-

Review the blank and stick to the recommendations. If you have never accomplished the template before, follow the line-to-line instructions.

-

Concentrate on the yellow fields. They are fillable and need specific data to get inserted. If you are uncertain what data to insert, see the instructions.

-

Always sign the SC DoR WH-1606. Utilize the built-in instrument to make the e-signature.

-

Click the date field to automatically put in the relevant date.

-

Re-read the sample to check on and change it before the submitting.

- Push the Done button in the top menu in case you have accomplished it.

-

Save, download or export the completed template.

Make use of US Legal Forms to guarantee comfortable and easy SC DoR WH-1606 completion

How to edit SC DoR WH-1606: customize forms online

Remove the mess from your paperwork routine. Discover the most effective way to find and edit, and file a SC DoR WH-1606

The process of preparing SC DoR WH-1606 requires accuracy and attention, especially from those who are not well familiar with this sort of job. It is important to find a suitable template and fill it in with the correct information. With the proper solution for handling paperwork, you can get all the instruments at hand. It is easy to simplify your editing process without learning additional skills. Identify the right sample of SC DoR WH-1606 and fill it out quickly without switching between your browser tabs. Discover more instruments to customize your SC DoR WH-1606 form in the modifying mode.

While on the SC DoR WH-1606 page, click on the Get form button to start modifying it. Add your data to the form on the spot, as all the essential instruments are at hand right here. The sample is pre-designed, so the effort required from the user is minimal. Simply use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode right away. Fill out the interactive field, and your document is all set.

Try more instruments to customize your form:

- Place more textual content around the document if needed. Use the Text and Text Box instruments to insert text in a separate box.

- Add pre-designed graphic components like Circle, Cross, and Check with respective instruments.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw instruments.

- Try the Highlight, Erase, and Blackout tools to change the text in the document.

- If you need to add comments to specific document parts, click the Sticky tool and place a note where you want.

Often, a small error can wreck the whole form when someone fills it manually. Forget about inaccuracies in your paperwork. Find the samples you need in moments and complete them electronically via a smart modifying solution.

If it's a photocopy of the original W-2 you can attach it to your tax return, as long as it's a clear readable copy. Make sure you keep a copy for yourself. Don't send the IRS your only copy. ... If you e-file you don't have to send in a copy of your W-2 at all.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.