Get Ky 765 Schedule K-1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 765 Schedule K-1 online

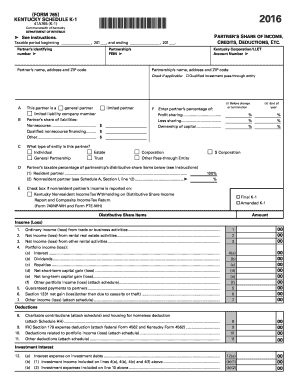

Filling out the KY 765 Schedule K-1 online is a crucial step for partners in a partnership to report their share of income, deductions, and credits to the Commonwealth of Kentucky. This guide provides clear, step-by-step instructions on how to complete the form efficiently and accurately.

Follow the steps to complete the KY 765 Schedule K-1 online

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the taxable period at the top of the form, filling in the months and year both for the beginning and ending dates.

- Input the partner’s identifying number and the partnership’s FEIN in the designated boxes.

- Provide the partner’s name, address, and ZIP code, followed by the partnership’s name, address, and ZIP code.

- If applicable, check the box for 'Qualified investment pass-through entity'.

- Indicate the type of partner (general partner, limited partner, etc.) and write in the partner's percentage for profit and loss sharing, as well as ownership of capital.

- Specify the type of entity for the partner, using the options provided.

- Complete the 'Distributive Share Items' section, detailing income (loss) from various activities, including but not limited to ordinary income, rental activities, and portfolio income.

- Fill out the deductions section if applicable, providing details for charitable contributions and other deductions.

- Outline any tax credits applicable to the partner, entering amounts per the instructions.

- Complete any other items as determined necessary for reporting, ensuring to attach any required schedules.

- After final review, save changes, download the completed form, print it for your records, or share it as necessary.

Begin filling out your KY 765 Schedule K-1 online today to ensure accurate tax reporting.

Get form

Related links form

The Kentucky partnership return form is KY Form 765, which is essential for partnerships operating in Kentucky. This form enables partnerships to report their income, expenses, and taxes owed. Completing this form accurately will result in issuing the trusty KY 765 Schedule K-1 to individual partners. If you need assistance with the partnership return forms, visit US Legal Forms for valuable resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.