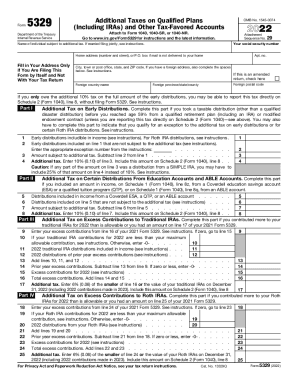

Get Irs 5329 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2022 5329 online

How to fill out and sign Irs 5329 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren?t associated with document administration and law processes, filling out IRS docs can be quite difficult. We fully grasp the necessity of correctly completing documents. Our platform offers the solution to make the mechanism of submitting IRS docs as elementary as possible. Follow these guidelines to correctly and quickly fill out IRS 5329.

How you can submit the IRS 5329 on the Internet:

-

Click on the button Get Form to open it and start modifying.

-

Fill all required lines in your file with our professional PDF editor. Switch the Wizard Tool on to finish the process even simpler.

-

Ensure the correctness of filled details.

-

Add the date of completing IRS 5329. Utilize the Sign Tool to create your personal signature for the record legalization.

-

Complete modifying by clicking on Done.

-

Send this record straight to the IRS in the most convenient way for you: via email, using digital fax or postal service.

-

You can print it out on paper if a copy is needed and download or save it to the preferred cloud storage.

Using our powerful solution can certainly make skilled filling IRS 5329 possible. make everything for your comfortable and easy work.

How to edit 5329 for 2022: customize forms online

Get rid of the mess from your paperwork routine. Discover the easiest way to find and edit, and file a 5329 for 2022

The process of preparing 5329 for 2022 demands accuracy and attention, especially from those who are not well familiar with this sort of job. It is essential to find a suitable template and fill it in with the correct information. With the proper solution for handling paperwork, you can get all the tools at hand. It is easy to streamline your editing process without learning new skills. Find the right sample of 5329 for 2022 and fill it out quickly without switching between your browser tabs. Discover more instruments to customize your 5329 for 2022 form in the modifying mode.

While on the 5329 for 2022 page, just click the Get form button to start modifying it. Add your information to the form on the spot, as all the necessary tools are at hand right here. The sample is pre-designed, so the work required from the user is minimal. Simply use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode straight away. Fill in the interactive field, and your file is good to go.

Try out more instruments to customize your form:

- Place more text around the document if needed. Use the Text and Text Box instruments to insert text in a separate box.

- Add pre-designed graphic elements like Circle, Cross, and Check with respective instruments.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw instruments.

- Try the Highlight, Erase, and Blackout tools to change the text in the document.

- If you need to add comments to specific document parts, click the Sticky tool and place a note where you want.

Often, a small error can wreck the whole form when someone fills it manually. Forget about inaccuracies in your paperwork. Find the templates you require in moments and complete them electronically via a smart modifying solution.

Yes, you can get form 5329 from TurboTax. ... The data entry in TurboTax to request a waiver depends on the following: a. If you have no Form 1099-R - you would have to manually prepare Form 5329 according to its instructions and request the waiver of penalty and to enter the explanation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.