Get Ky Dor 720s 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 720S online

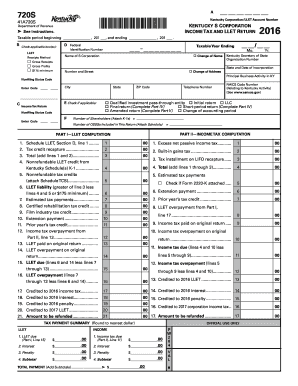

Filling out the KY DoR 720S is an essential step for Kentucky S corporations to report their income tax and limited liability entity tax. This guide provides detailed instructions on each component of the form to ensure a smooth and accurate filing process.

Follow the steps to accurately complete the KY DoR 720S online

- Press the ‘Get Form’ button to access the KY DoR 720S. This will allow you to obtain and open the form in your preferred format for editing.

- Begin by entering your Kentucky Corporation/LLET Account Number at the top of the form. This number is essential for identifying your business with the Department of Revenue.

- Select the applicable box for the Limited Liability Entity Tax (LLET) method. You will need to choose between gross receipts or gross profits.

- Provide your Federal Identification Number, the name of your S corporation, and the taxable year ending date.

- Indicate the number of shareholders and any Qualified Subchapter S Subsidiaries (QSSSs) included in the return. Make sure to attach the respective K-1 forms or schedules as required.

- Complete all relevant calculations in Parts I and II, including liabilities and deductions. Be thorough and check your calculations to ensure accuracy.

Complete your KY DoR 720S online today for a hassle-free filing experience.

Get form

Related links form

In Kentucky, LLCs are typically treated as pass-through entities for tax purposes, which means profits and losses can be reported on the owners' personal tax returns. However, LLCs can also elect to be taxed as a corporation if beneficial. Understanding the tax obligations for LLCs, particularly when filing forms like the KY DoR 720S, is crucial for ensuring proper compliance. Resources on uslegalforms can help clarify these obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.