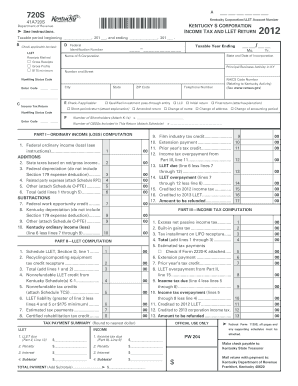

Get Ky Dor 720s 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign KY DoR 720S online

How to fill out and sign KY DoR 720S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your income and filing all necessary tax documents, including KY DoR 720S, is an exclusive responsibility of a US citizen. US Legal Forms makes your tax oversight clearer and more effective. You can locate any legal forms you require and fill them out digitally.

How to fill out KY DoR 720S online:

Store your KY DoR 720S securely. Ensure that all your accurate documents and information are organized while keeping in mind the deadlines and tax regulations established by the IRS. Make it simple with US Legal Forms!

- Access KY DoR 720S through your web browser from any device.

- Click to open the fillable PDF document.

- Begin filling in the template section by section, following the instructions of the advanced PDF editor's interface.

- Accurately enter text and numbers.

- Click on the Date field to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to create your personalized e-signature and verify it within minutes.

- Refer to the IRS guidelines if you still have any questions.

- Click Done to save the changes.

- Proceed to print the document, save it, or send it via email, text message, fax, or USPS without leaving your browser.

How to Modify Get KY DoR 720S 2012: personalize forms online

Utilize the functionality of the feature-rich online editor while completing your Get KY DoR 720S 2012. Employ the variety of tools to swiftly fill in the blanks and furnish the necessary information immediately.

Preparing paperwork is labor-intensive and expensive unless you possess pre-made fillable forms and finalize them digitally. The most efficient approach to managing the Get KY DoR 720S 2012 is to utilize our expert and versatile online editing services. We offer you all the essential tools for rapid document completion and allow you to make any modifications to your forms, tailoring them to any requirements. Additionally, you can comment on the revisions and leave notes for others involved.

Here’s what you can achieve with your Get KY DoR 720S 2012 in our editor:

Engaging with Get KY DoR 720S 2012 in our powerful online editor is the fastest and most effective manner to manage, submit, and share your documentation as required from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-connected device. All forms you create or complete are safely stored in the cloud, ensuring you can access them whenever necessary and be confident of not losing them. Stop squandering time on manual document completion and eliminate paper; accomplish everything online with minimal effort.

- Complete the blank fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize key information with a preferred color or underline them.

- Conceal sensitive data with the Blackout option or simply erase it.

- Insert images to illustrate your Get KY DoR 720S 2012.

- Substitute the original text with one that suits your needs.

- Add comments or sticky notes to discuss with others about the revisions.

- Remove unnecessary fillable fields and assign them to specific recipients.

- Secure the document with watermarks, add dates, and bates numbers.

- Distribute the document in various methods and save it on your device or cloud in different formats after editing.

Related links form

You typically need to file form 720 if you have taxable income in Kentucky. This includes wages, business earnings, and other income sources that exceed state thresholds. The KY DoR 720S can guide you through this decision-making process efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.