Get Ky Dor 92a201 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

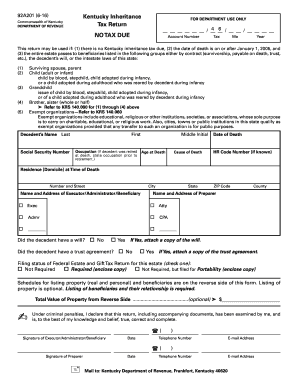

Tips on how to fill out, edit and sign KY DoR 92A201 online

How to fill out and sign KY DoR 92A201 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Accounting for your earnings and submitting all the essential tax documents, including KY DoR 92A201, is the exclusive responsibility of a US citizen.

US Legal Forms simplifies your tax management, making it more clear and efficient.

Keep your KY DoR 92A201 safe. Ensure all your necessary documents and records are organized while adhering to the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Access KY DoR 92A201 in your web browser on your device.

- Click to open the fillable PDF document.

- Start filling out the online template field by field, following the guidance of the advanced PDF editor's interface.

- Accurately enter text and data.

- Click the Date box to automatically insert the current date or manually adjust it.

- Utilize the Signature Wizard to create your unique e-signature and verify it within minutes.

- Refer to IRS guidelines if you have any remaining inquiries.

- Click Done to save your changes.

- Proceed to print the document, download it, or send it via Email, SMS, Fax, or USPS without leaving your web browser.

How to modify Get KY DoR 92A201 2016: tailor forms online

Experience a hassle-free and paperless method of managing with Get KY DoR 92A201 2016. Utilize our trustworthy online option and save a significant amount of time.

Creating each document, including Get KY DoR 92A201 2016, from the ground up consumes excessive time, so utilizing a reliable platform of pre-prepared document templates can work wonders for your productivity.

However, interacting with them can be challenging, particularly when dealing with documents in PDF format. Luckily, our extensive repository features a built-in editor that allows you to effortlessly fill out and modify Get KY DoR 92A201 2016 without having to leave our site, thereby saving you hours in processing your documents. Here’s what to do with your file using our tool:

Whether you need to process editable Get KY DoR 92A201 2016 or any other form available in our collection, you’re on the right track with our online document editor. It's simple and secure, and does not require specialized skills. Our web-based solution is configured to handle nearly everything you can envision regarding document editing and completion.

Stop using outdated methods for managing your documents. Opt for a professional solution to assist you in streamlining your tasks and making them less dependent on paper.

- Step 1. Find the required document on our platform.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing features that let you add, delete, comment, and highlight or redact text.

- Step 4. Generate and affix a legally-binding signature to your document by using the sign option in the top toolbar.

- Step 5. If the form structure doesn’t appear as you desire, use the options on the right to delete, add, and rearrange pages.

- Step 6. Include fillable fields so other participants can be invited to complete the form (if applicable).

- Step 7. Distribute or share the document, print it, or select the format in which you wish to download the file.

To obtain a Kentucky withholding number, you need to apply through the taxation division of the Kentucky Department of Revenue. Fill out the necessary registration forms and make sure to include the required information as per KY DoR 92A201. This number is vital for businesses to fulfill their withholding obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.