Get Ky Dor 92a205 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 92A205 online

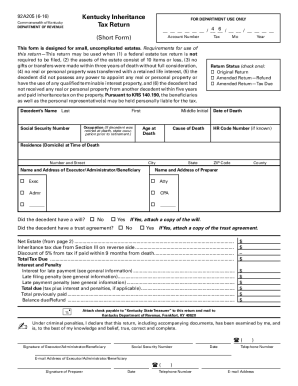

The KY DoR 92A205, also known as the Kentucky inheritance tax return, is a crucial document for reporting the inheritance tax for small estates. This guide provides step-by-step instructions on how to complete this form online, ensuring that users can navigate the process easily and accurately.

Follow the steps to fill out the KY DoR 92A205 online effectively.

- Click the ‘Get Form’ button to access the document and open it in the editor.

- Enter the decedent's name including last, first, and middle initial, along with their social security number, occupation at death, and date of death.

- Provide the decedent's residence address at the time of death, including the street number and name, city, state, county, and ZIP code.

- Fill in the name and address of the executor, administrator, or beneficiary, and indicate their role using the provided options.

- Select the return status (original, amended return—refund, or amended return—tax due) by checking the appropriate box.

- Indicate whether the decedent had a will and/or a trust agreement. If yes, attach copies of these documents.

- Calculate the net estate and inheritance tax due using the provided sections on gross estate and deductions.

- List all heirs and beneficiaries along with their distributive shares, ensuring totals equal the net estate.

- Sign and date the form as the executor, administrator, or beneficiary, and provide your social security number and contact information.

- Once all fields are completed and reviewed for accuracy, save changes and share, download, or print the form as needed.

Start completing your KY DoR 92A205 online today for a streamlined filing experience.

Related links form

In Kentucky, the maximum amount you can inherit without incurring taxes varies based on your relation to the deceased. While immediate family members face a $1 million exemption, other beneficiaries might have lower limits. It's important to review the KY DoR 92A205 guidelines for specifics relevant to your situation. Knowing these limits will help you plan your estate and inheritance effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.