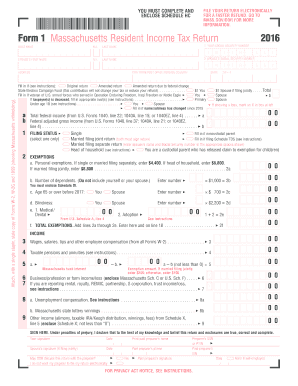

Get Ma Dor 1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR 1 online

How to fill out and sign MA DoR 1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and filing all the essential tax documents, including MA DoR 1, is a responsibility of every US citizen.

US Legal Forms simplifies your tax management, making it more efficient and precise. You can obtain any legal templates you need and fill them out electronically.

Store your MA DoR 1 safely. Ensure that all your accurate documents and records are organized properly while keeping in mind the deadlines and tax regulations established by the IRS. Make it simple with US Legal Forms!

- Access MA DoR 1 through your browser on your device.

- Click to open the fillable PDF file.

- Begin completing the online template section by section, following the instructions of the advanced PDF editor's interface.

- Carefully enter text and numerical data.

- Click on the Date field to automatically insert today's date or modify it manually.

- Utilize the Signature Wizard to create your unique electronic signature and validate it swiftly.

- Consult the IRS instructions if you have any uncertainties.

- Press Done to finalize your edits.

- Proceed to print the document, download it, or send it via Email, SMS, Fax, or USPS without leaving your browser.

How to modify Get MA DoR 1 2016: personalize forms online

Bid farewell to an outdated paper-based method of processing Get MA DoR 1 2016. Accomplish the document with signatures in no time using our premium online editor.

Are you required to update and finalize Get MA DoR 1 2016? With a professional tool like ours, you can complete this duty in just minutes without the hassle of printing and scanning documents repeatedly. We provide entirely editable and user-friendly document templates that will serve as a foundation and assist you in filling out the necessary template online.

All documents, by default, feature fillable fields that you can complete immediately upon opening the template. However, if you need to enhance the current content of the document or add new content, you can choose from a range of editing and annotation features. Emphasize, obscure, and comment on the document; incorporate checkmarks, lines, text boxes, graphics, notes, and comments. Furthermore, you can effortlessly certify the template with a legally-binding signature. The finalized document can be shared with others, stored, imported to third-party applications, or converted into any other format.

You’ll never make a mistake by utilizing our web-based solution to finalize Get MA DoR 1 2016 because it's:

Don't squander time editing your Get MA DoR 1 2016 the traditional way - with pen and paper. Utilize our feature-rich tool instead. It offers you a comprehensive range of editing options, built-in eSignature capabilities, and ease of use. The aspect that makes it unique is the team collaboration features - you can work on documents with anyone, establish a well-structured document approval process from scratch, and much more. Experience our online solution and achieve the best value for your investment!

- Simple to set up and use, even for individuals who haven’t filled out documents online before.

- Capable enough to meet diverse editing requirements and document categories.

- Safe and secure, ensuring your editing experience is protected each time.

- Accessible on various devices, making it convenient to complete the document from basically anywhere.

- Able to generate forms based on pre-drafted templates.

- Compatible with a variety of document formats: PDF, DOC, DOCX, PPT and JPEG, etc.

Related links form

Filling out Schedule 1 Line 1 requires you to enter your total income before any adjustments. It's important to review the instructions carefully to ensure accuracy. If you find it challenging, uslegalforms provides step-by-step guides to help you navigate your MA DoR 1 easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.