Get Ma Dor 1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR 1 online

How to fill out and sign MA DoR 1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Submitting your earnings and completing all the essential tax documentation, inclusive of MA DoR 1, is an obligation of a US citizen.

US Legal Forms simplifies your tax administration significantly and facilitates accuracy.

Store your MA DoR 1 safely. It is essential to make sure that all your relevant documents and information are organized correctly while adhering to the deadlines and tax regulations established by the IRS. Make it easy with US Legal Forms!

- Obtain MA DoR 1 directly in your web browser from your device.

- Access the fillable PDF document with a single click.

- Begin filling out the online template step by step, adhering to the instructions of the sophisticated PDF editor’s interface.

- Accurately enter text and numerical data.

- Click the Date field to automatically set today's date or adjust it manually.

- Utilize the Signature Wizard to generate your personalized e-signature and validate it in moments.

- Refer to Internal Revenue Service guidelines if you still have queries.

- Select Done to save the changes.

- Proceed to print the document, download it, or share it via Email, text, Fax, or USPS without closing your web browser.

How to modify Get MA DoR 1 2012: personalize forms online

Take advantage of the functionality of the feature-rich online editor while completing your Get MA DoR 1 2012. Utilize the array of tools to swiftly finish the fields and submit the necessary information in no time.

Creating documents can be labor-intensive and expensive unless you possess ready-to-use fillable templates and fill them out digitally. The simplest method to handle the Get MA DoR 1 2012 is to utilize our expert and feature-rich online editing solutions. We offer you all the essential tools for quick form completion and empower you to make any modifications to your forms, catering to any specifications. In addition, you can comment on the revisions and add notes for other participants.

Here’s what you can accomplish with your Get MA DoR 1 2012 in our editor:

Managing the Get MA DoR 1 2012 in our powerful online editor is the quickest and most effective way to handle, submit, and distribute your documents the way you prefer from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-connected device. All forms you create or complete are securely stored in the cloud, ensuring you can always reach them whenever necessary and feel assured that you won’t lose them. Stop wasting time on manual document completion and eliminate paperwork; do everything online with minimal effort.

- Complete the empty fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important information with a preferred color or highlight it.

- Conceal confidential details with the Blackout option or simply delete them.

- Insert images to illustrate your Get MA DoR 1 2012.

- Substitute the original text with one that matches your needs.

- Add comments or sticky notes to notify others about the changes.

- Include additional fillable sections and assign them to specific recipients.

- Secure the document with watermarks, add dates, and bates numbers.

- Distribute the document in various formats and save it on your device or the cloud as soon as you finish editing.

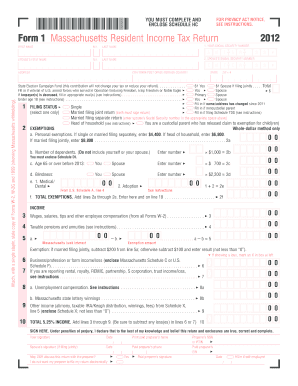

Massachusetts residents must file Form 1 if they have gross income, regardless of the source, exceeding the state's filing threshold. This form is essential for reporting income and calculating what you owe. Accurately filing Form 1 helps ensure you stay compliant and avoid potential penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.