Loading

Get Ca Ftb 100x 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100X online

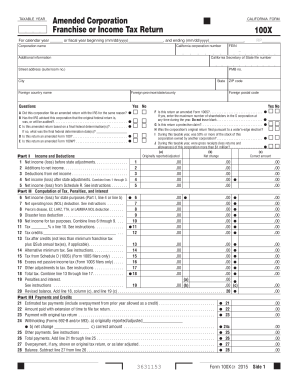

Filling out the CA FTB 100X form can seem daunting, but with a clear, step-by-step approach, you can complete it confidently. This guide will help users understand how to efficiently fill out the amended corporation franchise or income tax return online.

Follow the steps to fill out the CA FTB 100X form accurately.

- Press the ‘Get Form’ button to access the form and display it in the editing interface. This will allow you to begin entering your information seamlessly.

- Fill in the taxable year by specifying the calendar year or fiscal year you are amending, including the start and end dates in the required format (mm/dd/yyyy).

- Insert the corporation's name and California corporation number in the designated fields. Also, provide any additional address information like PMB number, city, state, and ZIP code.

- Answer the questions A through E, regarding your IRS filings and whether this amended return corresponds with any federal determinations.

- Navigate to Part I titled 'Income and Deductions.' Complete the sections detailing your net income, additions to net income, and deductions from net income.

- In Part II, proceed to compute your tax, penalties, and interest based on the income figures from Part I. Accurately fill out each line as per the instructions provided.

- Complete Part III regarding payments and credits, including estimated tax payments and withholding amounts as relevant to your situation.

- Fill in Part IV to calculate any amount due or refund based on the information provided, ensuring all calculations are accurate.

- In Part V, explain the changes made to your return by entering the previous corporation name, number, and a detailed explanation of any amendments. Be sure to attach supporting documents as required.

- Finalize the form by signing it. You are required to provide the signature of an officer, their title, the date, and if applicable, the preparer's information.

Complete your CA FTB 100X form online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The tax on $100,000 in California depends on various factors, such as the entity type and applicable tax rates. For corporations, the tax rate is generally based on a flat percentage of net income. If you are unsure, using the CA FTB 100X can help you correct any misreported amounts and ensure compliance with state tax regulations. Check with UsLegalForms for guidance on how to navigate California's tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.